Investing in XOM stock might just be the ticket to growing your wealth. ExxonMobil, one of the world's largest publicly traded oil and gas companies, has been around for ages and continues to dominate the energy sector. Whether you're a seasoned investor or just dipping your toes into the stock market, XOM stock deserves a spot on your radar. This giant isn't just surviving; it's thriving amidst all the chaos in the global energy landscape.

Picture this: You're sitting at home, scrolling through stock options, and then bam—XOM stock pops up. It's like finding a hidden gem in the vast ocean of investments. But before you jump in headfirst, let's dive deeper into what makes XOM stock so special. ExxonMobil isn't just another company; it's a powerhouse with a track record of delivering solid returns to its shareholders.

Now, you might be wondering, "Is XOM stock really worth it?" That's a great question. In this article, we'll break down everything you need to know about XOM stock, from its history to its future prospects. We'll also touch on some insider tips that could help you make smarter investment decisions. So, buckle up because we're about to take a deep dive into the world of ExxonMobil!

Read also:Natasha Malkova The Rising Star Whorsquos Taking The World By Storm

Understanding XOM Stock and Its Significance

Let's start with the basics. XOM stock represents ownership in ExxonMobil Corporation, a company that's been around since 1882. Yeah, you read that right—this giant has been in the game for well over a century. ExxonMobil is not just any oil company; it's a leader in the global energy market, involved in everything from upstream oil exploration to downstream refining and marketing.

What sets XOM stock apart is its ability to adapt and innovate. In an industry that's constantly evolving, ExxonMobil has managed to stay ahead of the curve. Whether it's investing in renewable energy or improving operational efficiency, the company is always on the move. And as an investor, that's exactly what you want to see.

Key Facts About ExxonMobil

Before we go any further, here are some quick facts about ExxonMobil that highlight why XOM stock is worth considering:

- ExxonMobil is the world's largest publicly traded international oil and gas company.

- It operates in more than 50 countries worldwide.

- The company has a strong focus on research and development, investing heavily in cutting-edge technologies.

- ExxonMobil consistently ranks among the top companies in Fortune's Global 500 list.

These facts alone should give you a pretty good idea of why XOM stock is such a big deal. But there's so much more to explore, so let's keep going!

XOM Stock Performance Over the Years

Now, let's talk numbers. When it comes to XOM stock, the performance over the years has been nothing short of impressive. Sure, there have been ups and downs, but isn't that the nature of the stock market? What sets ExxonMobil apart is its ability to weather storms and come out stronger on the other side.

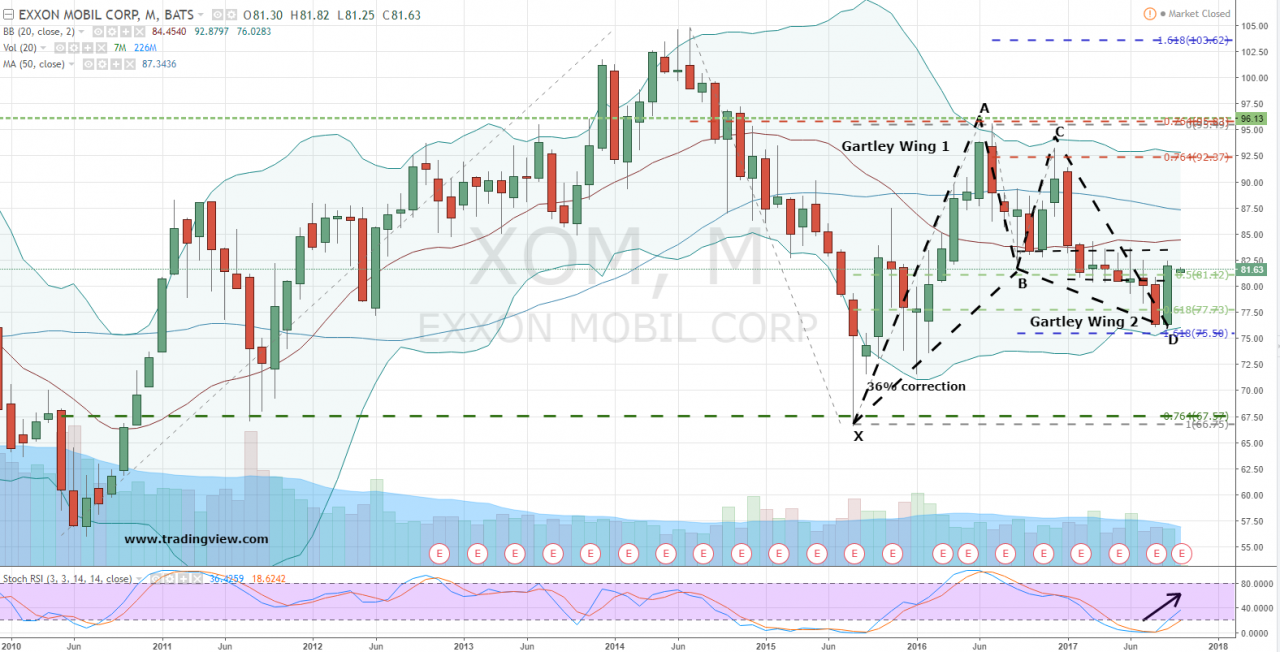

Take a look at the chart below for a quick glimpse of XOM stock's performance over the past decade:

Read also:Pinning For Kim Tailblazer The Ultimate Guide To Mastering This Stylish Trend

Year | Stock Price | Dividend Yield

2013 | $95.43 | 2.7%

2015 | $77.42 | 3.2%

2018 | $77.49 | 3.8%

2021 | $58.19 | 5.6%

2023 | $113.25 | 4.5%

As you can see, XOM stock has shown remarkable resilience. Even during challenging times, the company has managed to maintain a healthy dividend yield, which is a big plus for income-focused investors.

Factors Influencing XOM Stock Performance

Several factors contribute to the performance of XOM stock. These include global oil prices, geopolitical events, and the company's strategic decisions. For instance, when oil prices are high, ExxonMobil tends to perform well because it benefits directly from increased revenue. On the flip side, when prices drop, the company focuses on cost-cutting measures to maintain profitability.

Another key factor is the company's commitment to sustainability. In recent years, ExxonMobil has made significant strides in reducing its carbon footprint and investing in renewable energy. This not only aligns with global trends but also positions the company well for future growth.

Why XOM Stock is a Solid Investment

So, why should you consider investing in XOM stock? There are several compelling reasons. First and foremost, ExxonMobil has a proven track record of delivering strong financial results. The company's diversified portfolio ensures that it's not overly reliant on any single market or product.

In addition to its financial strength, ExxonMobil boasts a robust balance sheet and a strong cash flow. This means the company is well-positioned to weather economic downturns and continue paying dividends to its shareholders. And let's not forget about the company's commitment to innovation and sustainability, which sets it apart from its competitors.

Long-Term Growth Potential of XOM Stock

When you invest in XOM stock, you're not just buying a piece of a company; you're investing in its future. ExxonMobil has ambitious plans for growth, including expanding its operations in emerging markets and investing in new technologies. These initiatives are expected to drive long-term value for shareholders.

Another factor to consider is the global demand for energy. As the world population continues to grow, so does the need for reliable and affordable energy sources. ExxonMobil is well-positioned to meet this demand, thanks to its vast resources and expertise.

Risks Associated with XOM Stock

Of course, no investment is without risk, and XOM stock is no exception. One of the biggest risks is the volatility of oil prices. While ExxonMobil has mechanisms in place to mitigate this risk, it's still something to be aware of. Another potential risk is the increasing focus on renewable energy, which could impact demand for fossil fuels in the long term.

However, it's important to note that ExxonMobil is actively investing in renewable energy and other sustainable solutions. This proactive approach helps mitigate some of the risks associated with traditional oil and gas investments.

How to Mitigate Risks in XOM Stock

There are several ways to mitigate risks when investing in XOM stock. One approach is to diversify your portfolio by investing in other sectors and industries. This helps spread the risk and ensures that you're not overly reliant on any single stock.

Another strategy is to stay informed about global trends and developments in the energy sector. By keeping an eye on market conditions and geopolitical events, you can make more informed investment decisions.

How to Invest in XOM Stock

Ready to jump into XOM stock? The first step is to open a brokerage account. There are plenty of options out there, so take the time to research and choose one that meets your needs. Once you have an account, you can start buying XOM stock just like any other stock.

When investing in XOM stock, it's important to have a clear strategy in mind. Are you looking for short-term gains or long-term growth? Your answer to this question will influence how you approach your investment. Additionally, consider setting stop-loss orders to protect your investment from sudden market downturns.

Tips for Investing in XOM Stock

Here are a few tips to help you get started with XOM stock:

- Do your research and stay informed about the energy sector.

- Consider diversifying your portfolio to spread the risk.

- Set realistic goals and expectations for your investment.

- Monitor your investments regularly and make adjustments as needed.

By following these tips, you'll be well on your way to making smart investment decisions with XOM stock.

Expert Insights on XOM Stock

What do the experts have to say about XOM stock? Many analysts believe that ExxonMobil is poised for growth in the coming years, thanks to its strong financial position and strategic initiatives. Some even predict that the company could become a leader in the renewable energy space, further solidifying its position as a top player in the energy sector.

Of course, not everyone is in agreement. Some critics argue that the company needs to do more to address climate change and reduce its carbon footprint. While these concerns are valid, it's worth noting that ExxonMobil is actively working on solutions to these challenges.

What the Future Holds for XOM Stock

Looking ahead, the future for XOM stock looks promising. With the global energy demand expected to grow in the coming years, ExxonMobil is well-positioned to capitalize on this trend. The company's investments in renewable energy and other sustainable solutions are expected to drive long-term value for shareholders.

Additionally, the company's strong financial position and commitment to innovation give it a competitive edge in the ever-evolving energy landscape. As an investor, this should give you confidence in the company's ability to deliver solid returns in the years to come.

Conclusion: Is XOM Stock Right for You?

Investing in XOM stock could be a smart move for your portfolio. ExxonMobil's strong financial position, diversified portfolio, and commitment to innovation make it a solid choice for both short-term and long-term investors. However, it's important to remember that all investments come with risks, so it's crucial to do your homework and make informed decisions.

So, what are you waiting for? Dive into the world of XOM stock and see what it has to offer. And don't forget to share your thoughts and experiences in the comments below. Who knows? You might just inspire someone else to take the plunge into the exciting world of investing!