Let’s talk about something that sends shivers down the spines of investors and traders alike: the bear market. If you’ve ever heard the phrase "bear market" and wondered what it means, you’re in the right place. A bear market is like a storm cloud looming over the financial world, where stock prices plummet, and investor confidence takes a nosedive. It’s not just about numbers; it’s about the psychology of fear and uncertainty that grips the market. So, buckle up because we’re diving deep into what a bear market is, why it happens, and how you can weather the storm.

You might be thinking, “Why do they call it a bear market anyway?” Well, the term comes from the way a bear swipes its paws downward, symbolizing the downward trend in prices. But don’t worry, this isn’t just about bears and paws; it’s about understanding the mechanics of the market, how it impacts your investments, and what you can do to protect yourself when the market turns sour.

Here’s the deal: a bear market isn’t just some random event that happens out of nowhere. It’s a phase in the economic cycle that has specific characteristics and triggers. By the end of this article, you’ll have a clear picture of what a bear market is, how to spot one, and most importantly, how to navigate it like a pro. So, let’s get started, shall we?

Read also:Cheryl Herrin The Ultimate Guide To Her Life Career And Achievements

Table of Contents:

- What is a Bear Market?

- History of Bear Markets

- Causes of Bear Markets

- Characteristics of a Bear Market

- Bear Market vs Bull Market

- Investing in a Bear Market

- Psychology of Bear Markets

- Tips for Surviving a Bear Market

- Common Mistakes in a Bear Market

- Future Predictions for Bear Markets

What is a Bear Market?

A bear market is basically a period when the prices of stocks or other financial assets fall significantly and stay low for an extended period. Typically, it’s defined as a drop of 20% or more from recent highs in a broad market index, like the S&P 500. But it’s not just about numbers; it’s about the overall sentiment in the market. When investors start panicking and selling off their holdings, it creates a ripple effect that can drag the entire market down.

Think of it like this: imagine you’re at a party, and everyone’s having a great time. Suddenly, someone whispers that the host is broke, and the mood shifts. People start leaving, and the energy in the room drops. That’s kind of what happens in a bear market, except instead of people leaving a party, they’re selling their stocks.

How Long Do Bear Markets Last?

The duration of a bear market can vary wildly. Some last for just a few months, while others drag on for years. It all depends on the underlying causes and how quickly the market can recover. Historically, bear markets tend to last anywhere from 9 months to 2 years, but there’s no hard and fast rule. The key is to stay patient and avoid making impulsive decisions based on short-term fluctuations.

History of Bear Markets

Let’s take a trip down memory lane and look at some of the most infamous bear markets in history. From the Great Depression to the 2008 financial crisis, these events have left lasting scars on the global economy. But they’ve also taught us valuable lessons about resilience and adaptability.

The Great Depression

The Great Depression, which began in 1929, is often cited as one of the worst bear markets in history. The stock market crashed, and it took years for the economy to recover. It was a time of widespread poverty, unemployment, and despair. But it also led to significant reforms in the financial system, like the creation of the Securities and Exchange Commission (SEC).

Read also:Unveiling The Enigma Francesco Calliano A Name That Resonates

The Dot-Com Bubble

Fast forward to the late 1990s, and we have the dot-com bubble. Investors were throwing money at anything related to the internet, regardless of whether the companies had solid business models. When the bubble burst in 2000, the market plunged, and many tech companies went bankrupt. It was a wake-up call for investors to focus on fundamentals rather than hype.

Causes of Bear Markets

So, what exactly causes a bear market? There’s no single answer, but there are several common triggers. Economic recessions, geopolitical tensions, and unexpected events like pandemics can all contribute to a bear market. Let’s break it down:

- Economic Recessions: When the economy slows down, companies earn less money, and investors lose confidence. This can lead to a downward spiral in stock prices.

- Geopolitical Tensions: Wars, trade disputes, and political instability can create uncertainty in the market, causing investors to sell off their holdings.

- Unexpected Events: Things like natural disasters or pandemics can disrupt supply chains and hurt businesses, leading to a bear market.

Characteristics of a Bear Market

A bear market isn’t just defined by falling prices; it has several distinct characteristics that set it apart from other market phases. Here are some of the key traits:

- Declining Stock Prices: As we mentioned earlier, a bear market is typically defined by a 20% or more drop in stock prices.

- Pessimistic Sentiment: Investors become pessimistic and lose confidence in the market, leading to more selling.

- Increased Volatility: Prices can swing wildly as investors try to predict the bottom of the market.

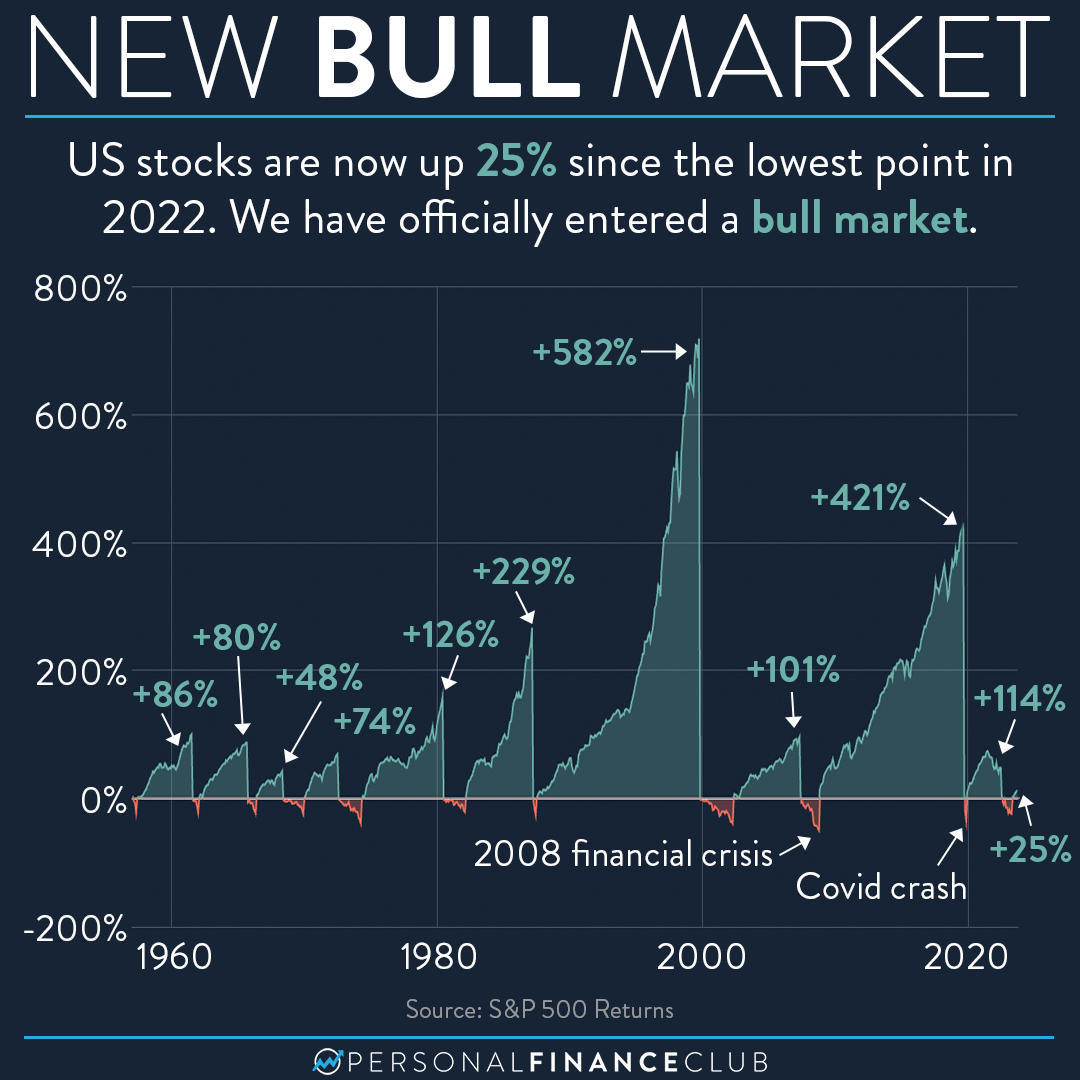

Bear Market vs Bull Market

While a bear market represents a downward trend, a bull market is the exact opposite. In a bull market, stock prices are rising, and investor confidence is high. Think of it like this: a bull charges forward, just like the market during a bull phase. Here’s a quick comparison:

Key Differences

- Bear Market: Falling prices, pessimism, and uncertainty.

- Bull Market: Rising prices, optimism, and growth.

Investing in a Bear Market

Investing during a bear market can be tricky, but it’s not impossible. In fact, some of the best opportunities arise during these times. Here are a few strategies to consider:

Dollar-Cost Averaging

This is a technique where you invest a fixed amount of money at regular intervals, regardless of the market conditions. It helps you avoid the temptation to time the market and can lead to better long-term returns.

Value Investing

Value investors look for stocks that are undervalued and have strong fundamentals. These stocks may perform better when the market eventually recovers.

Psychology of Bear Markets

One of the most fascinating aspects of bear markets is the psychology behind them. Fear and greed often drive investor behavior, leading to irrational decisions. Here are some common psychological pitfalls to watch out for:

- Panic Selling: Investors sell off their holdings in a frenzy, exacerbating the decline.

- Herding Behavior: People follow the crowd, even if it means making poor investment decisions.

Tips for Surviving a Bear Market

Surviving a bear market requires a combination of strategy and mental fortitude. Here are some tips to help you navigate the storm:

- Stay Calm: Don’t let fear dictate your decisions. Stick to your long-term investment plan.

- Diversify Your Portfolio: Spreading your investments across different asset classes can reduce risk.

Common Mistakes in a Bear Market

Even the most experienced investors can make mistakes during a bear market. Here are some common errors to avoid:

Chasing Losses

Trying to recover losses by doubling down on failing investments is a recipe for disaster. It’s better to cut your losses and move on.

Future Predictions for Bear Markets

While no one can predict the future with certainty, historical patterns can give us some clues about what to expect. With advancements in technology and globalization, the market is more interconnected than ever. This means that future bear markets could be more complex and unpredictable. However, one thing is for sure: they will happen again. The key is to be prepared and adaptable.

Kesimpulan

A bear market is a challenging phase in the financial world, but it’s not the end of the world. By understanding its causes, characteristics, and effects, you can navigate it with confidence. Remember to stay calm, focus on the long term, and avoid making emotional decisions. And don’t forget: every bear market eventually comes to an end, and the market usually recovers. So, keep your eyes on the prize and ride out the storm.

Now it’s your turn. Have you ever experienced a bear market? What strategies did you use to survive it? Share your thoughts in the comments below, and don’t forget to check out our other articles for more insights into the world of finance.