Investing in AMD stock has become one of the hottest topics in the tech world. Everyone from casual investors to seasoned Wall Street pros is buzzing about this semiconductor giant. Whether you're looking to grow your portfolio or just curious about what all the fuss is about, AMD stock deserves your attention. This isn't just another tech stock; it's a game-changer that's reshaping the industry.

If you’ve been following the stock market, you’ve probably noticed AMD making waves. The company, formally known as Advanced Micro Devices, has been on a tear over the last few years. Its stock performance has been nothing short of impressive, and there’s a good reason for that. But hold up—before we dive into the nitty-gritty, let’s talk about why AMD is such a big deal right now. This isn’t just about numbers; it’s about innovation, strategy, and a company that’s proving it can compete with the best.

Whether you’re new to investing or a seasoned pro, understanding AMD stock is crucial if you want to stay ahead of the curve. The tech industry moves fast, and AMD is right at the forefront of that movement. So, buckle up because we’re about to break down everything you need to know about AMD stock—and why it’s worth your time and money.

Read also:Clix Haircut Name The Trend Thats Cutting It In The Hair World

Let's jump into the details, shall we?

- AMD: A Quick Biography

- AMD Stock Market Performance

- AMD's Innovation in the Semiconductor Industry

- Competitors and AMD's Edge

- Financial Highlights of AMD

- Long-Term Growth Potential

- Risks and Challenges Facing AMD

- Investor Sentiment and Market Trends

- Future Outlook for AMD Stock

- Final Thoughts on AMD Stock

AMD: A Quick Biography

Let’s take a trip down memory lane and talk about AMD’s journey. Founded way back in 1969, AMD started as a small semiconductor company with big dreams. Fast forward to today, and it’s one of the most recognizable names in the tech industry. Headquartered in sunny Santa Clara, California, AMD has been at the forefront of innovation for decades.

Key Milestones in AMD's History

AMD hasn’t always been the tech giant it is today. Here are some of the key milestones that shaped the company:

- 1980s: AMD became the second source for Intel’s 8086 and 8088 processors, a move that laid the foundation for its future success.

- 2000s: AMD introduced the Athlon processor, which was a game-changer in the PC market. It was the first 64-bit processor for consumer PCs.

- 2010s: AMD faced some tough times but bounced back with the Ryzen series, which revitalized its brand and reputation.

- 2020s: AMD is now a dominant player in both the CPU and GPU markets, with partnerships with major tech companies like Microsoft and Sony.

| Year | Event |

|---|---|

| 1969 | AMD Founded |

| 1980 | Second Source Agreement with Intel |

| 2003 | Launch of Athlon 64 Processor |

| 2017 | Introduction of Ryzen Processors |

| 2023 | Continued Growth in GPU and CPU Markets |

AMD Stock Market Performance

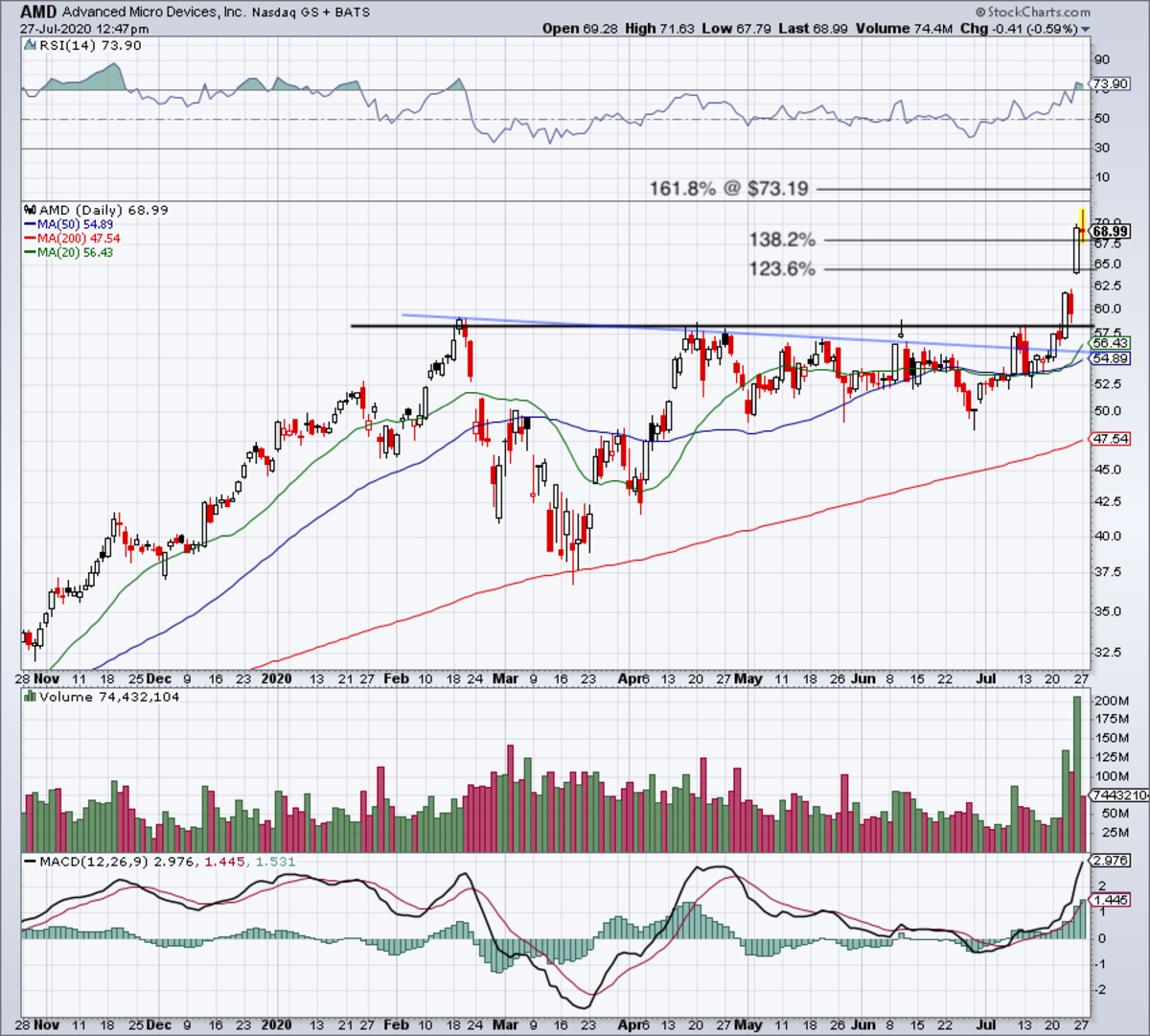

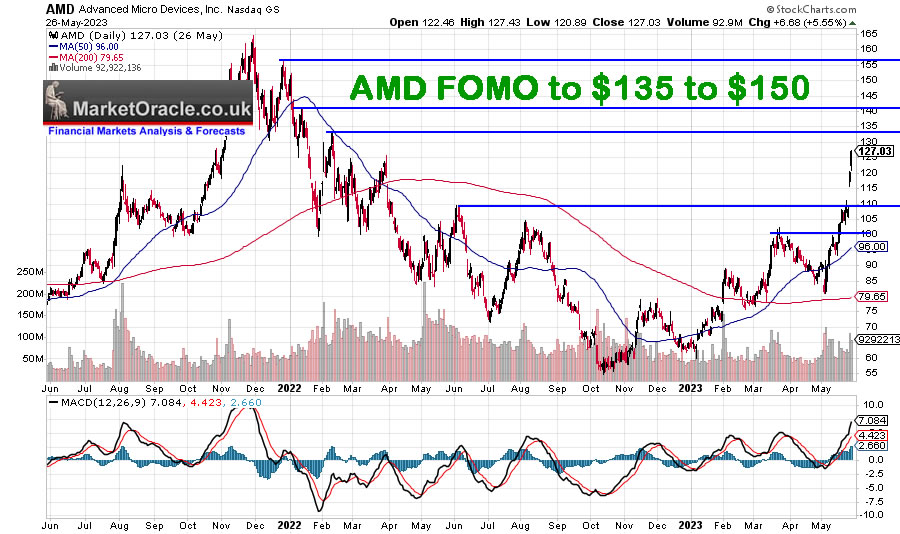

Now, let’s talk about what really matters to investors: the stock performance. AMD stock has been on a wild ride over the past few years. In 2018, the stock was trading around $10 per share. Fast forward to today, and it’s trading at a much higher price. That’s some serious growth, folks.

What’s Driving AMD’s Stock Surge?

A few factors have contributed to AMD’s stock surge:

- Innovation: AMD’s Ryzen and EPYC processors have been game-changers in the market.

- Market Demand: With the rise of remote work and gaming, demand for high-performance processors has skyrocketed.

- Partnerships: Collaborations with big names like Microsoft, Sony, and Google have boosted AMD’s profile.

Of course, the stock market can be unpredictable, but AMD’s fundamentals look strong. Analysts are bullish on AMD’s future, and that’s music to investors’ ears.

Read also:Valvoline Coupon 25 Synthetic 50 Off Your Ultimate Guide To Big Savings

AMD's Innovation in the Semiconductor Industry

AMD isn’t just another semiconductor company; it’s a leader in innovation. The company’s Ryzen and EPYC processors have set new standards in performance and efficiency. But what makes AMD’s innovation so special?

Key Innovations Driving AMD’s Success

- Ryzen Processors: These bad boys have taken the PC market by storm, offering top-tier performance at competitive prices.

- EPYC Processors: Designed for data centers, EPYC processors are delivering unparalleled performance and efficiency.

- Graphics Solutions: AMD’s Radeon graphics cards are giving NVIDIA a run for its money in the gaming market.

Innovation isn’t just about creating new products; it’s about solving real-world problems. AMD’s focus on energy efficiency and performance is resonating with consumers and businesses alike.

Competitors and AMD's Edge

AMD isn’t the only player in the semiconductor game. Companies like Intel and NVIDIA are fierce competitors. So, what gives AMD the edge?

How AMD Stands Out from the Competition

- Price-Performance Ratio: AMD offers high-performance products at competitive prices, making them attractive to budget-conscious consumers.

- Product Diversification: AMD isn’t just about CPUs; it’s also a major player in the GPU market.

- Strong Partnerships: Collaborations with tech giants give AMD a leg up in the market.

While Intel and NVIDIA are strong competitors, AMD’s focus on innovation and affordability is helping it carve out a niche in the market.

Financial Highlights of AMD

When it comes to investing, the numbers don’t lie. AMD’s financials tell a compelling story of growth and profitability. In recent quarters, AMD has reported strong revenue growth and increasing profitability. The company’s focus on high-margin products like EPYC processors is paying off.

Key Financial Metrics

- Revenue Growth: AMD’s revenue has been growing steadily, with year-over-year increases.

- Profit Margins: AMD’s gross profit margins have been improving, indicating better efficiency and pricing power.

- Cash Flow: Strong cash flow generation has enabled AMD to invest in R&D and expand its product lineup.

Investors love to see a company with solid financials, and AMD is delivering on that front.

Long-Term Growth Potential

So, what does the future hold for AMD stock? The outlook is promising. With the continued growth of cloud computing, AI, and gaming, AMD is well-positioned to capitalize on these trends. The company’s focus on innovation and partnerships will be key to its long-term success.

Factors Driving Long-Term Growth

- Cloud Computing: Data centers are increasingly adopting AMD’s EPYC processors for their performance and efficiency.

- Artificial Intelligence: AMD’s graphics solutions are playing a crucial role in AI applications.

- Gaming Industry: The gaming market continues to grow, and AMD’s Radeon cards are a major player.

AMD’s long-term growth potential is tied to its ability to innovate and adapt to changing market conditions. If it stays on this trajectory, the sky’s the limit.

Risks and Challenges Facing AMD

Of course, no investment is without risks. AMD faces several challenges that could impact its stock performance. The semiconductor industry is highly competitive, and AMD must continue to innovate to stay ahead.

Key Risks to Watch Out For

- Supply Chain Issues: Global chip shortages could impact AMD’s ability to meet demand.

- Competition: Intel and NVIDIA are formidable competitors that could challenge AMD’s market share.

- Economic Downturns: A slowdown in the global economy could impact demand for AMD’s products.

Investors need to be aware of these risks and assess whether they’re comfortable with them before diving into AMD stock.

Investor Sentiment and Market Trends

Investor sentiment plays a big role in stock performance. Right now, AMD stock is riding high on positive sentiment. Analysts are bullish, and retail investors are piling in. But what’s driving this sentiment?

Factors Influencing Investor Sentiment

- Product Success: AMD’s Ryzen and EPYC processors are resonating with consumers and businesses.

- Market Trends: Growth in cloud computing, AI, and gaming is boosting demand for AMD’s products.

- Financial Performance: AMD’s strong financials are giving investors confidence in its future.

While sentiment can be fickle, AMD’s fundamentals suggest that the positive vibes could stick around for a while.

Future Outlook for AMD Stock

Looking ahead, AMD stock has a bright future. The company’s focus on innovation, strong financials, and growing demand for its products position it well for long-term success. Of course, there are risks to consider, but AMD’s track record suggests it’s up to the challenge.

What to Expect from AMD in the Coming Years

- New Product Launches: AMD will continue to roll out cutting-edge products that push the boundaries of performance and efficiency.

- Market Expansion: The company will likely expand into new markets, further diversifying its revenue streams.

- Increased Market Share: AMD’s competitive edge should help it gain market share from rivals like Intel and NVIDIA.

AMD stock isn’t just a good investment; it’s a bet on the future of technology. And if history is any indication, AMD is a company that delivers on its promises.

Final Thoughts on AMD Stock

AMD stock has been a standout performer in the tech sector, and there’s good reason for that. The company’s focus on innovation, strong financials, and growing demand for its products make it an attractive investment. While there are risks to consider, AMD’s track record suggests it’s up to the challenge.

So, if you’re thinking about adding AMD stock to your portfolio, now might be a great time. The tech industry is evolving rapidly, and AMD is right at the forefront of that movement. Whether you’re a long-term investor or just looking for a quick win, AMD stock is worth your attention.

What are you waiting for? Dive in, do your research, and see if AMD stock is the right fit for your portfolio. And don’t forget to share this article with your friends and fellow investors. Knowledge is power, and AMD is proving that every day.