Investing can sometimes feel like navigating a maze filled with acronyms, but one that’s been making waves is TQQQ. If you’ve heard about it and are curious to learn more, you’re in the right place. TQQQ is not just another ETF; it’s a powerhouse designed to amplify your gains—or losses—in the tech-heavy Nasdaq-100 index. Think of it as the turbocharged version of your typical index fund, but with a few twists that make it both exciting and risky.

So, why should you care? TQQQ has become a favorite among traders who want to ride the wave of tech stocks without directly picking individual companies. It’s like betting on the whole tech industry with a multiplier. But hey, before you jump in, there’s a lot you need to know. In this article, we’ll break it down for you in a way that’s easy to digest, even if you’re new to the world of investing.

Whether you’re here because you want to understand what TQQQ is, how it works, or if it’s right for your portfolio, we’ve got you covered. Stick around, and let’s dive into the nitty-gritty of this triple-leveraged ETF. Promise we’ll keep it fun and straightforward, no boring finance jargon allowed.

Read also:Jay Ma The Son Of A Tech Titan Rises To Fame

What Exactly is TQQQ?

Let’s start with the basics. TQQQ stands for ProShares UltraPro QQQ, and it’s an ETF that’s been around since 2010. Now, ETFs are like mutual funds but trade on exchanges like stocks. What makes TQQQ unique is that it’s a triple-leveraged ETF. That means it aims to deliver three times the daily performance of the Nasdaq-100 index. If the Nasdaq goes up 1%, TQQQ theoretically goes up 3%. Cool, right? But wait, there’s more.

Why TQQQ is Different from Regular ETFs

Regular ETFs usually track an index one-to-one. TQQQ, on the other hand, uses derivatives and financial wizardry to amplify returns. This makes it super attractive to traders who want to capitalize on short-term market moves. But here’s the catch: leverage works both ways. If the Nasdaq drops 1%, TQQQ could fall by 3%. Over time, this compounding effect can erode your investment, even if the underlying index doesn’t move much.

Who Should Invest in TQQQ?

Not everyone should jump into TQQQ. It’s not for the faint of heart or for those looking for a steady, long-term investment. TQQQ is best suited for experienced traders who understand the risks and are comfortable with volatility. If you’re someone who loves taking calculated risks and has a good grasp of how markets work, TQQQ might be worth exploring.

Risk Factors to Consider

Here’s the deal: TQQQ is volatile. Like, really volatile. The daily price swings can be massive, and if you’re not prepared for that, it can be nerve-wracking. Also, because it’s a leveraged ETF, it’s designed for short-term trading. Holding it for too long can lead to something called volatility drag, where the compounding effect of daily losses eats away at your returns. So, if you’re thinking of buying and holding TQQQ forever, you might want to rethink that strategy.

How TQQQ Works: Breaking It Down

Let’s get into the mechanics. TQQQ uses financial instruments like swaps and futures to achieve its 3x leverage. Essentially, it borrows money to amplify its exposure to the Nasdaq-100. This allows it to deliver those juicy 3x returns when the market is up. But remember, leverage is a double-edged sword. When the market goes down, those losses get magnified too.

Key Features of TQQQ

- Triple Leverage: Designed to deliver 3x the daily return of the Nasdaq-100.

- Short-Term Focus: Best used for trading, not long-term investing.

- High Volatility: Expect big price swings on a daily basis.

- Expense Ratio: Comes with a 0.95% management fee, which can add up over time.

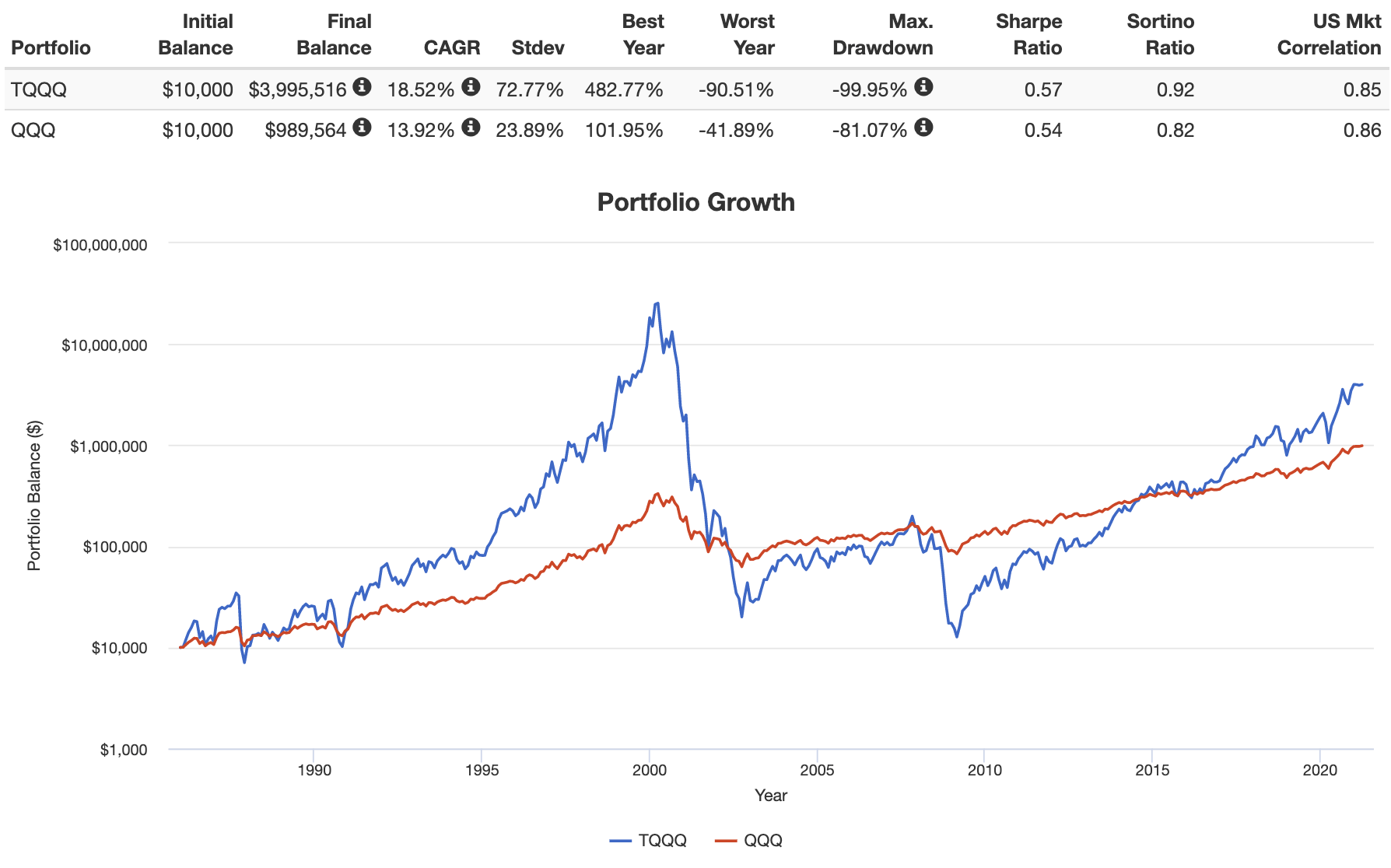

TQQQ vs QQQ: What’s the Difference?

QQQ is the regular ETF that tracks the Nasdaq-100 without any leverage. It’s like TQQQ’s chill cousin. While TQQQ gives you 3x the daily returns, QQQ sticks to the 1x approach. This makes QQQ a better option for long-term investors who want exposure to the tech-heavy Nasdaq-100 without the added risk of leverage.

Read also:Valvoline Coupon 25 Synthetic 50 Off Near Me The Ultimate Guide To Save Big

When to Choose TQQQ Over QQQ

If you’re bullish on tech and believe the Nasdaq-100 is about to rally, TQQQ could help you capitalize on that move. However, if you’re looking for a more stable, long-term investment, QQQ is probably the safer bet. It all depends on your risk tolerance and investment goals.

Historical Performance of TQQQ

Looking at TQQQ’s historical performance can give you a glimpse of its potential—and its risks. Since its inception in 2010, TQQQ has delivered some impressive gains during bull markets. However, during market downturns, it has also experienced significant losses. This rollercoaster ride is exactly why TQQQ is not for everyone.

Key Stats to Know

- TQQQ has returned an average of 38.2% annually since its launch (as of 2023).

- During the 2020 market crash, TQQQ dropped by over 60% in a matter of weeks.

- In 2021, TQQQ gained over 50% as tech stocks soared.

Is TQQQ a Good Investment for Beginners?

Not really. Beginners should steer clear of leveraged ETFs like TQQQ. They’re complex financial instruments that require a solid understanding of how markets work. If you’re just starting out, it’s better to stick with plain vanilla ETFs or index funds that offer more stability and predictability.

Tips for Beginners

- Start with low-risk investments like index funds or mutual funds.

- Learn the basics of investing before diving into leveraged products.

- Always do your research and consult a financial advisor if needed.

How to Trade TQQQ Successfully

If you’re determined to trade TQQQ, here are a few tips to help you navigate its volatility:

- Set Clear Goals: Know why you’re trading TQQQ and what you hope to achieve.

- Use Stop-Loss Orders: Protect yourself from big losses by setting stop-loss orders.

- Stay Informed: Keep an eye on market news and trends that could impact tech stocks.

Final Thoughts: Is TQQQ Worth It?

TQQQ is a powerful tool for experienced traders who want to amplify their gains in the tech sector. However, it’s not without its risks. The volatility and leverage make it unsuitable for most investors, especially beginners. If you’re considering TQQQ, make sure you fully understand how it works and the risks involved.

So, what’s the takeaway? TQQQ can be a great way to capitalize on short-term market moves, but it requires a lot of skill and discipline to trade successfully. If you’re up for the challenge, go for it. But if you’re looking for a more stable investment, there are plenty of other options out there.

Got questions or thoughts? Drop a comment below and let’s chat. And don’t forget to share this article with your friends who might find it helpful. Happy investing!

Table of Contents

- What Exactly is TQQQ?

- Who Should Invest in TQQQ?

- How TQQQ Works: Breaking It Down

- TQQQ vs QQQ: What’s the Difference?

- Historical Performance of TQQQ

- Is TQQQ a Good Investment for Beginners?

- How to Trade TQQQ Successfully

- Final Thoughts: Is TQQQ Worth It?