Let’s face it, folks – Oracle stock is more than just a ticker symbol on Wall Street. It’s a powerhouse in the tech world, and if you’re thinking about diving into the world of investing, this is one company you don’t want to overlook. Whether you’re a seasoned investor or just starting out, understanding Oracle stock is like having a cheat code to the tech industry. So, grab your coffee, and let’s break it down together.

Oracle Corporation is no stranger to the limelight. Founded back in 1977 by Larry Ellison, Bob Miner, and Ed Oates, this company has grown into a tech giant that dominates the database management system market. If you’re looking to invest in a company with a solid track record, Oracle stock might just be the golden ticket you’ve been searching for.

But hold up – before you jump in headfirst, it’s important to know what you’re getting into. In this guide, we’ll dive deep into everything you need to know about Oracle stock. From its history and financial performance to future growth potential, we’ve got you covered. So, let’s get started, shall we?

Read also:Pining For Kim Tailblazer Free The Ultimate Guide To Unlocking Your Fashion Potential

Here’s a quick rundown of what we’ll cover:

- Biography of Oracle Corporation

- Oracle Stock Financial Performance

- Market Analysis of Oracle Stock

- Growth Potential for Oracle Stock

- Risks Associated with Oracle Stock

- Oracle Stock Dividends

- Long-Term Investment Strategy

- Competitors in the Tech Space

- Expert Opinions on Oracle Stock

- Conclusion and Final Thoughts

Biography of Oracle Corporation

Before we dive into the nitty-gritty of Oracle stock, let’s take a moment to understand the company behind the ticker symbol. Oracle Corporation is more than just a name – it’s a legacy.

Founding and Early Days

Back in 1977, three brilliant minds – Larry Ellison, Bob Miner, and Ed Oates – came together to create what would eventually become Oracle Corporation. Initially named Software Development Laboratories (SDL), the company quickly gained traction for its innovative database management system.

By 1983, SDL had rebranded to Oracle Systems Corporation, and the rest, as they say, is history. Oracle’s flagship product, Oracle Database, became a game-changer in the tech world, offering businesses a reliable and scalable solution for managing their data.

Key Milestones

- 1983 – Oracle Database becomes the first relational database management system to use SQL.

- 1990s – Oracle expands its product portfolio with middleware and application software.

- 2000s – Oracle acquires several companies, including PeopleSoft and Sun Microsystems, solidifying its position in the tech industry.

- 2010s – Oracle shifts focus to cloud computing, positioning itself as a leader in the cloud space.

Oracle Stock Financial Performance

Now that we’ve got the backstory out of the way, let’s talk numbers. Oracle’s financial performance is a key factor to consider when evaluating Oracle stock as an investment option.

Revenue Growth

Over the years, Oracle has consistently delivered solid revenue growth. In the fiscal year 2023, Oracle reported revenue of over $42 billion, marking a steady increase from previous years. This growth can be attributed to Oracle’s diverse product offerings and its strategic focus on cloud computing.

Read also:Cuck Meme The Ultimate Guide To Understanding The Viral Phenomenon

Profit Margins

Oracle’s profit margins have remained strong, with operating margins consistently above 30%. This indicates that the company is efficiently managing its costs and maximizing profitability. For investors, this is a good sign of a well-run business.

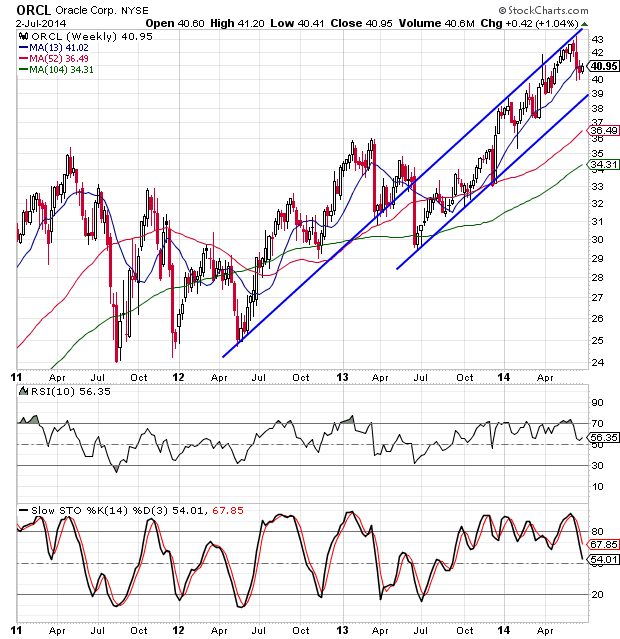

Market Analysis of Oracle Stock

Understanding the market dynamics surrounding Oracle stock is crucial for making informed investment decisions. Let’s take a closer look at the factors influencing Oracle’s position in the market.

Industry Trends

The tech industry is constantly evolving, and Oracle is no exception. With the rise of cloud computing, artificial intelligence, and big data, Oracle has positioned itself at the forefront of these trends. Its cloud infrastructure and applications have gained significant traction, making it a formidable player in the market.

Competitive Landscape

While Oracle is a leader in the tech space, it faces stiff competition from companies like Microsoft, Amazon, and Google. However, Oracle’s unique offerings, such as its autonomous database and cloud solutions, set it apart from its competitors. This differentiation is key to its success in the market.

Growth Potential for Oracle Stock

So, you’re probably wondering – what’s the future hold for Oracle stock? The answer lies in its growth potential. Oracle has several cards up its sleeve that could drive future growth.

Cloud Expansion

Oracle’s focus on cloud computing is a major driver of its growth potential. With more businesses moving to the cloud, Oracle’s cloud infrastructure and applications are poised to capture a larger share of the market. This shift presents a significant opportunity for Oracle stock investors.

Global Expansion

Oracle is not just limited to the US market. It has a strong presence in international markets, and its expansion efforts continue to gain momentum. By tapping into emerging markets, Oracle can further boost its revenue and profitability.

Risks Associated with Oracle Stock

Of course, no investment is without risks. Oracle stock is no exception. Here are some of the key risks to consider before investing:

Economic Uncertainty

The global economy is unpredictable, and economic downturns can impact Oracle’s revenue and profitability. As a global company, Oracle is exposed to various economic factors that could affect its performance.

Technological Disruption

In the fast-paced tech industry, staying ahead of the curve is crucial. Oracle must continue to innovate and adapt to new technologies to remain competitive. Failure to do so could result in a loss of market share and revenue.

Oracle Stock Dividends

For income-focused investors, Oracle stock offers a compelling dividend yield. Oracle has a history of paying regular dividends, making it an attractive option for those seeking steady income.

Dividend History

Oracle has consistently increased its dividend payouts over the years. In 2023, Oracle announced a dividend increase of 15%, demonstrating its commitment to rewarding shareholders. This trend is likely to continue, making Oracle stock a solid choice for dividend investors.

Long-Term Investment Strategy

If you’re considering Oracle stock as part of your long-term investment strategy, here’s what you need to know:

Focus on Innovation

Oracle’s emphasis on innovation is a key factor in its long-term success. By investing in cutting-edge technologies like AI and cloud computing, Oracle is positioning itself for future growth. For investors, this focus on innovation translates to long-term value creation.

Strong Financial Position

Oracle’s strong financial position provides a solid foundation for future growth. With a healthy balance sheet and robust cash flow, Oracle is well-equipped to navigate economic uncertainties and capitalize on new opportunities.

Competitors in the Tech Space

As we mentioned earlier, Oracle faces stiff competition in the tech space. Let’s take a closer look at some of its key competitors:

Microsoft

Microsoft is a formidable competitor in the cloud computing space. With its Azure platform, Microsoft has gained significant market share, posing a challenge to Oracle’s cloud offerings.

Amazon

Amazon Web Services (AWS) is another major player in the cloud market. Its dominance in the space makes it a tough competitor for Oracle. However, Oracle’s unique solutions, such as its autonomous database, offer a competitive edge.

Expert Opinions on Oracle Stock

What do the experts have to say about Oracle stock? Here’s a roundup of opinions from industry analysts:

Positive Outlook

Many analysts are bullish on Oracle stock, citing its strong financial performance and growth potential. They believe that Oracle’s focus on cloud computing and innovation will drive future success.

Cautious Approach

Some analysts urge caution, pointing to the risks associated with economic uncertainty and technological disruption. However, they acknowledge Oracle’s resilience and ability to adapt to changing market conditions.

Conclusion and Final Thoughts

There you have it – a comprehensive guide to Oracle stock. From its rich history to its growth potential, Oracle offers a compelling investment opportunity for those looking to tap into the tech industry.

So, what’s the takeaway? Oracle stock is a solid choice for investors who value innovation, financial stability, and long-term growth potential. Whether you’re a seasoned investor or just starting out, Oracle stock is definitely worth considering.

And hey, don’t just take our word for it. Do your own research, consult with a financial advisor, and make an informed decision. After all, it’s your money, and your life. So, take action – leave a comment, share this article, or dive deeper into the world of Oracle stock. The choice is yours, folks!

/Oracle Corp_ office logo-by Mesut Dogan via iStock.jpg)