Hey there, savvy investor! If you're diving into the world of stocks and markets, you’ve probably heard the term "S&P 500 Chart" being thrown around like confetti at a stock market party. But what exactly is this chart, and why should you care? Let’s break it down for you in a way that’s simple, relatable, and packed with insights. The S&P 500 chart isn’t just a random line on a graph—it’s a crucial tool that can shape your investment decisions and financial future.

Picture this: the stock market is like a giant, unpredictable beast that can make or break your wealth. The S&P 500 chart acts as your compass, guiding you through the chaos. It represents the performance of 500 of the largest publicly traded companies in the U.S., giving you a snapshot of how the overall market is doing. Whether you're a rookie investor or a seasoned pro, understanding this chart is key to making smart moves.

But wait—why focus on the S&P 500? Why not the Dow Jones or some other fancy-sounding index? Well, the S&P 500 is considered the gold standard because it covers a broader range of industries and companies compared to its peers. It’s like the all-in-one package deal when it comes to gauging the health of the U.S. economy. Let’s dig deeper and uncover why this chart matters so much to your wallet.

Read also:G Baby Erome The Ultimate Guide To Understanding The Phenomenon

What is the S&P 500 Chart?

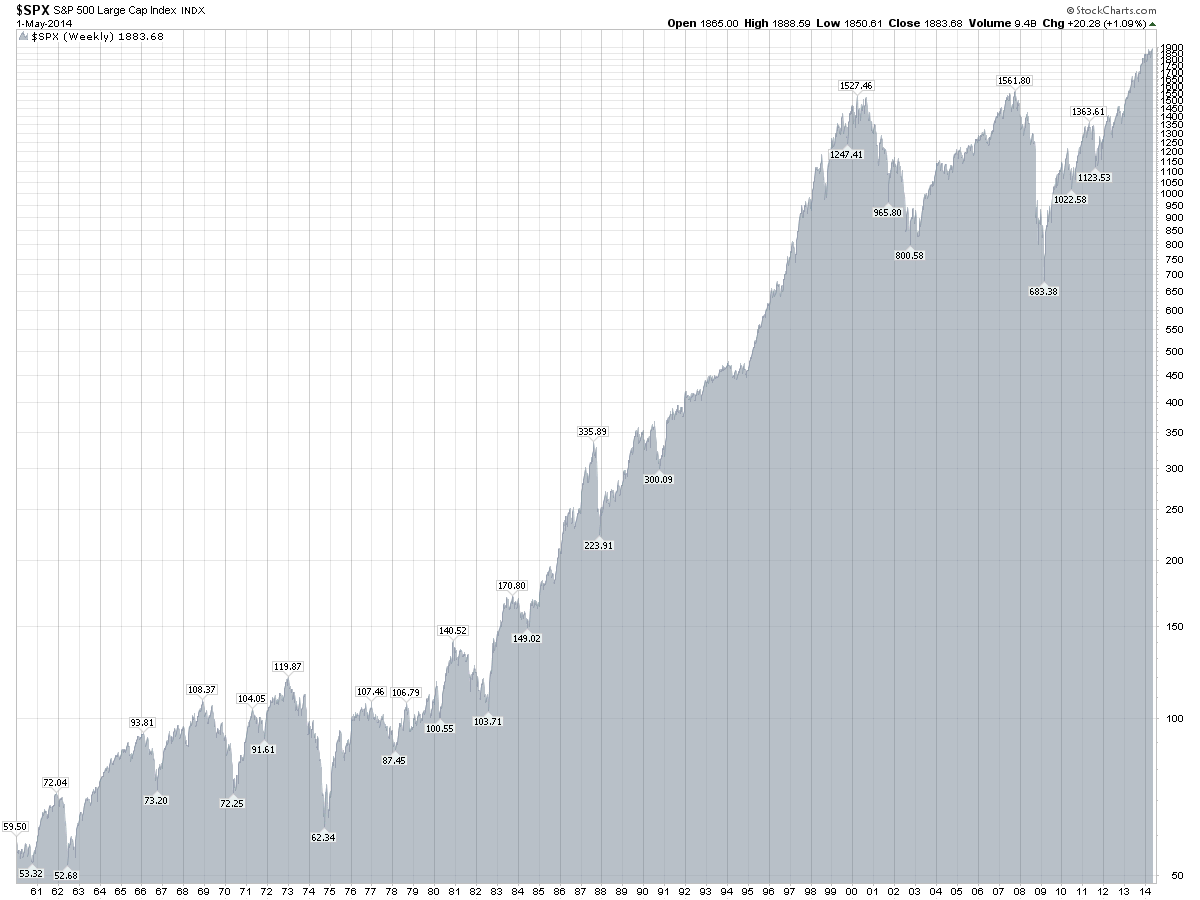

The S&P 500 chart is essentially a visual representation of how the S&P 500 index performs over time. Think of it as a timeline that shows you the ups and downs of the market. Each point on the chart reflects the value of the index at a specific moment, influenced by factors like company earnings, economic indicators, and global events. It’s not just a bunch of random numbers—it’s a story of how the market evolves.

This chart isn’t just for show; it’s a powerful tool for investors. By analyzing trends and patterns, you can make informed decisions about buying, selling, or holding stocks. For example, if the chart shows a consistent upward trend, it might indicate a bullish market, which could be a good time to invest. Conversely, if it’s trending downward, it might signal a bearish market, prompting you to reconsider your strategy.

Why the S&P 500 Chart Matters

Here’s the deal: the S&P 500 chart isn’t just for financial geeks or Wall Street wizards. It matters to anyone who has a stake in the market, whether you’re managing your retirement fund or dabbling in day trading. Here are a few reasons why:

- Benchmarking: The S&P 500 chart serves as a benchmark for evaluating the performance of individual stocks, mutual funds, and ETFs. If your investments are underperforming compared to the S&P 500, it might be time to reevaluate your strategy.

- Risk Assessment: By studying the chart, you can identify periods of volatility and assess the risks associated with certain investments. This helps you prepare for potential downturns and protect your portfolio.

- Trend Analysis: The chart reveals long-term trends that can guide your investment decisions. For instance, if the chart shows a steady increase over the past decade, it might suggest a strong economic outlook.

How to Read the S&P 500 Chart

Reading the S&P 500 chart might seem intimidating at first, but it’s simpler than you think. Let’s break it down step by step:

Understanding Key Components

Every chart has essential elements that you need to know. The x-axis typically represents time, while the y-axis shows the value of the index. The line connecting the dots illustrates how the index has performed over a specific period. Some charts may also include additional features like volume indicators or moving averages to provide deeper insights.

Let’s say you’re looking at a one-year chart. You’ll notice peaks and troughs that correspond to major events, such as interest rate changes, corporate earnings reports, or geopolitical tensions. These fluctuations give you a glimpse into what’s driving the market at any given moment.

Read also:Andrew Burkle The Man Behind The Curtain Of Success

Identifying Trends

Trends are crucial for making predictions. An upward trend indicates that the market is gaining momentum, while a downward trend suggests the opposite. However, it’s important to remember that trends can reverse quickly, so always stay vigilant. Some common trends you might encounter include:

- Bull Market: A prolonged period of rising prices, often fueled by optimism and strong economic growth.

- Bear Market: A phase where prices decline, usually due to economic uncertainty or investor pessimism.

- Sideways Market: A situation where prices remain relatively stable, indicating a lack of clear direction.

Factors Influencing the S&P 500 Chart

The S&P 500 chart doesn’t move in a vacuum. It’s affected by a wide range of factors, both internal and external. Here are some of the key drivers:

Economic Indicators

Economic data, such as GDP growth, employment rates, and inflation numbers, play a significant role in shaping the chart. For example, if the economy is booming, companies tend to perform better, leading to an uptick in the index. On the flip side, a sluggish economy can cause the chart to dip.

Corporate Earnings

The financial performance of the companies included in the S&P 500 directly impacts the chart. When companies report strong earnings, investor confidence increases, driving the index higher. Conversely, poor earnings can lead to a sell-off, causing the chart to decline.

Global Events

Geopolitical tensions, trade wars, and natural disasters can have a profound effect on the market. For instance, a sudden geopolitical crisis might trigger a flight to safety, pushing investors to sell their stocks and seek safer assets like gold or bonds.

Using the S&P 500 Chart for Investment Decisions

Now that you understand what the S&P 500 chart is and how it works, let’s talk about how you can use it to enhance your investment strategy. Here are a few practical tips:

Long-Term vs. Short-Term

Your approach to the S&P 500 chart depends on your investment horizon. If you’re a long-term investor, focus on the overall trend rather than short-term fluctuations. For short-term traders, analyzing daily or weekly charts can help identify entry and exit points.

Risk Management

Always consider risk when using the S&P 500 chart. Diversify your portfolio to minimize exposure to any single stock or sector. Additionally, set stop-loss orders to protect your investments from sudden market downturns.

Technical Analysis

Technical analysis involves using charts and indicators to predict future price movements. Tools like moving averages, relative strength index (RSI), and Fibonacci retracements can provide valuable insights. However, remember that no method is foolproof, so use them as part of a broader strategy.

Historical Performance of the S&P 500 Chart

To truly appreciate the power of the S&P 500 chart, it’s helpful to look back at its historical performance. Over the past century, the index has experienced remarkable growth, punctuated by occasional setbacks. For example, during the dot-com boom of the late 1990s, the chart soared to unprecedented heights, only to crash in the early 2000s. Similarly, the 2008 financial crisis caused a sharp decline, followed by a robust recovery in the years that followed.

These historical patterns highlight the cyclical nature of the market and emphasize the importance of patience and perseverance. While short-term volatility can be nerve-wracking, the long-term trend has consistently been upward, rewarding those who stay the course.

Tools and Resources for Analyzing the S&P 500 Chart

Fortunately, you don’t have to rely on guesswork when analyzing the S&P 500 chart. There are plenty of tools and resources available to help you make sense of the data:

Online Platforms

Websites like Yahoo Finance, Google Finance, and Bloomberg offer real-time S&P 500 charts, along with news and analysis. These platforms are user-friendly and provide a wealth of information for both beginners and experts.

Charting Software

If you’re serious about chart analysis, consider using specialized software like TradingView or MetaTrader. These tools offer advanced features, such as customizable charts, technical indicators, and real-time updates.

Financial Advisors

Don’t hesitate to seek advice from a professional financial advisor. They can provide personalized guidance based on your goals, risk tolerance, and financial situation. Sometimes, a fresh perspective can make all the difference.

Common Misconceptions About the S&P 500 Chart

There are a few myths surrounding the S&P 500 chart that can lead to misinformed decisions. Let’s debunk some of them:

Myth #1: The Chart Always Predicts the Future

While the S&P 500 chart can provide valuable insights, it’s not a crystal ball. Markets are inherently unpredictable, and past performance is no guarantee of future results. Always consider other factors before making investment decisions.

Myth #2: Higher Is Always Better

A rising chart might seem like a good thing, but it can also signal an overheated market. Overvaluation can lead to a correction or crash, so proceed with caution when the chart is soaring.

Myth #3: It’s Only for Professionals

Contrary to popular belief, the S&P 500 chart is accessible to everyone. With the right tools and knowledge, you can use it to enhance your investment strategy, regardless of your experience level.

Conclusion

In a nutshell, the S&P 500 chart is an indispensable tool for anyone serious about investing. It provides a wealth of information about the market’s performance, helping you make informed decisions and navigate the ups and downs of the financial world. By understanding its components, analyzing trends, and leveraging available resources, you can harness the power of the S&P 500 chart to achieve your financial goals.

So, what’s next? Take action! Start exploring the S&P 500 chart today, and don’t forget to share your thoughts and experiences in the comments below. Whether you’re a rookie or a veteran, there’s always something new to learn. Happy investing!

Table of Contents

- What is the S&P 500 Chart?

- Why the S&P 500 Chart Matters

- How to Read the S&P 500 Chart

- Factors Influencing the S&P 500 Chart

- Using the S&P 500 Chart for Investment Decisions

- Historical Performance of the S&P 500 Chart

- Tools and Resources for Analyzing the S&P 500 Chart

- Common Misconceptions About the S&P 500 Chart

- Conclusion