Investing in TSM stock isn’t just about putting your money into a company—it’s like joining a movement that’s reshaping the future of technology. If you’ve been keeping an eye on the stock market, chances are you’ve heard whispers about TSMC (Taiwan Semiconductor Manufacturing Company) and its incredible growth potential. This isn’t your average stock; it’s a powerhouse that’s driving innovation across the globe, and understanding what makes TSM stock tick is key to unlocking its potential.

Let’s break it down in plain terms. TSM stock represents ownership in one of the world’s most advanced semiconductor manufacturers. In today’s digital age, semiconductors are the backbone of pretty much everything—your smartphone, your laptop, even your car. Without semiconductors, modern life as we know it would grind to a halt. And TSMC? They’re the ones making sure those tiny chips keep getting better, faster, and more efficient.

But here’s the kicker: TSM stock isn’t just about tech geeks or industry insiders. It’s for anyone who wants to be part of something big. Whether you’re a seasoned investor or someone just dipping their toes into the stock market, TSM stock offers a unique opportunity to ride the wave of technological advancement. So, buckle up, because we’re about to dive deep into why TSM stock deserves your attention.

Read also:Valvoline Coupon 25 Synthetic 50 Off Your Ultimate Guide To Big Savings

Understanding the Basics of TSM Stock

What Exactly is TSM Stock?

TSM stock is the publicly traded equity of Taiwan Semiconductor Manufacturing Company (TSMC), which is the largest independent semiconductor foundry in the world. Think of TSMC as the factory that builds the brains behind all your favorite gadgets. Companies like Apple, NVIDIA, and Qualcomm rely heavily on TSMC to produce their cutting-edge chips, and that dependency is only growing stronger as technology advances.

What sets TSMC apart is its focus on innovation. They’re constantly pushing the boundaries of what’s possible with chip manufacturing. For example, they’re leading the charge in developing 3nm and even 2nm chip technologies, which are mind-blowingly small but incredibly powerful. And when you own TSM stock, you’re essentially betting on their ability to keep delivering these game-changing innovations.

Why Should You Care About TSMC?

Here’s the thing: TSMC isn’t just another company in the tech space. They’re a linchpin in the global supply chain. If TSMC weren’t around, the tech industry would be in serious trouble. Their dominance in the semiconductor market gives them unmatched leverage, and that leverage translates into profitability for shareholders.

Let’s put it in perspective. TSMC controls over 50% of the global semiconductor foundry market. That’s a staggering figure, and it shows just how essential they are to the tech ecosystem. And with the demand for semiconductors expected to skyrocket in the coming years, TSM stock is positioned to benefit immensely from this trend.

Key Factors Driving TSM Stock Growth

The Rise of Artificial Intelligence

Artificial intelligence (AI) is one of the biggest drivers of demand for advanced semiconductors. As AI applications become more widespread, from self-driving cars to personalized healthcare, the need for powerful processing capabilities is growing exponentially. TSMC is at the forefront of this revolution, producing chips that can handle the complex computations required by AI systems.

For instance, TSMC’s collaboration with companies like NVIDIA and AMD has resulted in some of the most advanced AI accelerators on the market. These chips are designed to handle massive datasets and perform calculations at lightning speeds, making them indispensable for AI research and development. By investing in TSM stock, you’re essentially backing the companies that are shaping the future of AI.

Read also:Why Vegamovies Original Is A Mustvisit For Movie Lovers

5G Technology and Beyond

Another major factor driving TSM stock growth is the rollout of 5G technology. 5G networks require more advanced semiconductors to handle the increased data speeds and connectivity demands. TSMC is a key player in this space, providing the chips that power 5G-enabled devices.

But it doesn’t stop there. As we move towards 6G and beyond, the demand for even more advanced semiconductors will only continue to grow. TSMC’s leadership in chip manufacturing ensures that they’ll be at the forefront of this next wave of technological innovation, making TSM stock a smart long-term investment.

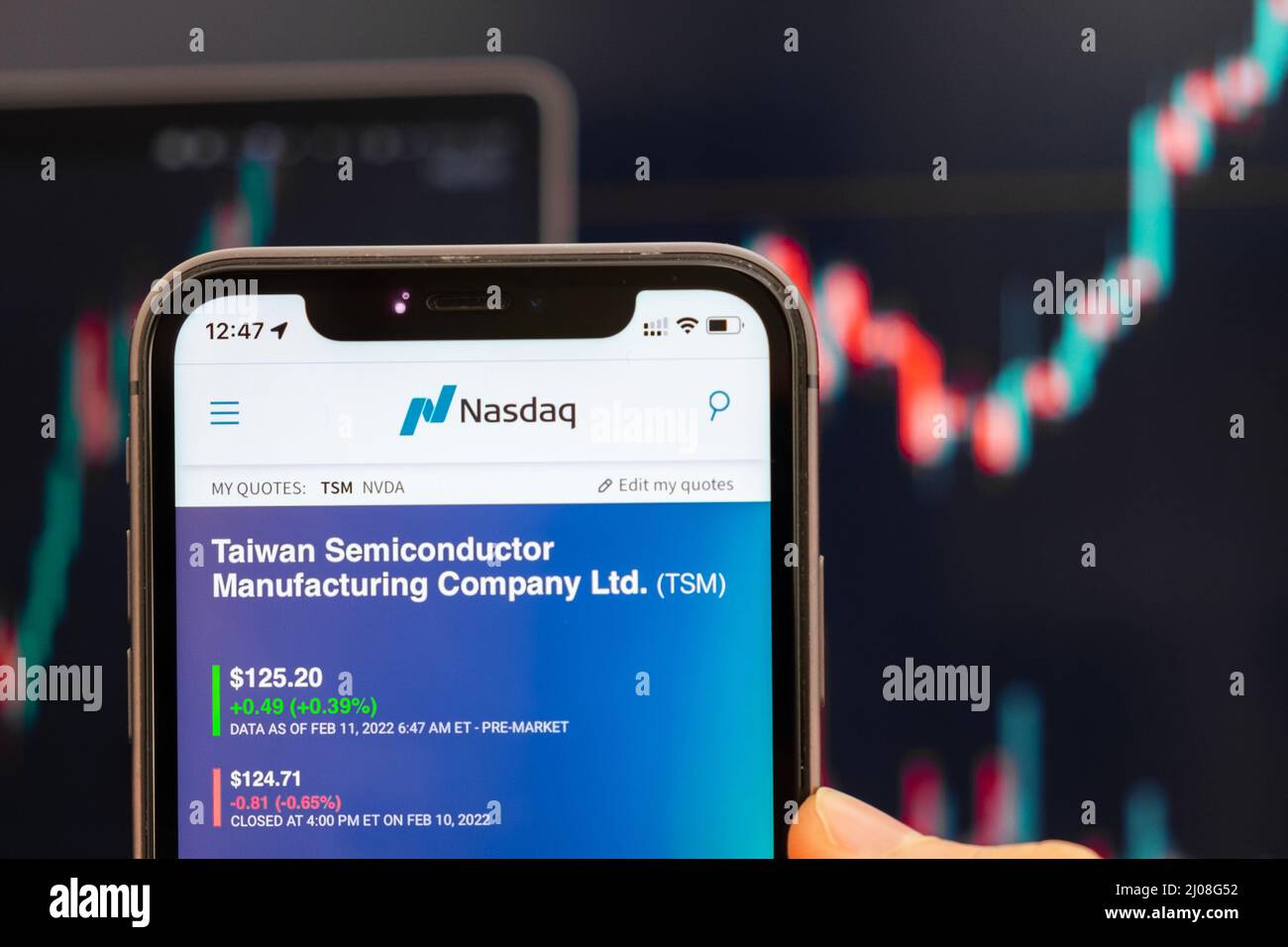

TSM Stock Performance and Market Trends

Historical Performance of TSM Stock

When you look at the historical performance of TSM stock, one thing becomes abundantly clear: this is a stock that delivers. Over the past decade, TSM stock has consistently outperformed the market, rewarding investors with impressive returns.

Take a look at these numbers. From 2010 to 2020, TSM stock saw a compound annual growth rate (CAGR) of over 15%. That’s significantly higher than the average stock market return. And while past performance doesn’t guarantee future results, it does give you a good indication of TSMC’s ability to generate value for its shareholders.

Current Market Trends

Right now, the semiconductor industry is experiencing unprecedented growth. The global semiconductor market is projected to reach $800 billion by 2030, and TSMC is poised to capture a significant share of that growth. This isn’t just about increasing demand for chips; it’s also about the increasing complexity of those chips.

As more industries adopt digital technologies, the need for advanced semiconductors will continue to rise. From automotive to healthcare, the applications for semiconductors are expanding rapidly. And with TSMC leading the charge in chip manufacturing, TSM stock is in a prime position to benefit from these trends.

Investor Sentiment and Analyst Outlook

What the Experts Are Saying

Analysts across the board are bullish on TSM stock. They see it as a long-term growth opportunity with immense potential. One analyst from a major investment bank recently stated, “TSMC is the crown jewel of the semiconductor industry. Their leadership in advanced chip manufacturing is unmatched, and their growth trajectory is nothing short of extraordinary.”

Investor sentiment is also overwhelmingly positive. Many investors view TSM stock as a safe bet in an otherwise volatile market. The company’s strong financials, coupled with its dominant market position, make it an attractive option for both conservative and aggressive investors.

Future Growth Prospects

Looking ahead, the future of TSM stock looks incredibly bright. With ongoing investments in research and development, TSMC is well-positioned to maintain its leadership in the semiconductor industry. They’re already planning for the next generation of chip technologies, ensuring that they stay ahead of the curve.

Additionally, TSMC’s expansion into new markets, such as automotive semiconductors, opens up new revenue streams and growth opportunities. As more industries adopt digital technologies, the demand for TSMC’s chips will only continue to grow, driving up the value of TSM stock.

Risks and Challenges

Geopolitical Risks

While TSM stock has a lot going for it, there are risks to consider. One of the biggest challenges facing TSMC is geopolitical tension. As a company based in Taiwan, TSMC operates in a region that’s often at the center of geopolitical disputes. Any disruption in the region could impact TSMC’s operations and, by extension, TSM stock.

However, TSMC has taken steps to mitigate these risks. They’ve established partnerships with governments and companies around the world to ensure a stable supply chain. Additionally, their diversification into multiple markets helps reduce reliance on any one region.

Technological Risks

Another risk to consider is the rapid pace of technological change. While TSMC is currently at the forefront of chip manufacturing, staying ahead in such a fast-moving industry is no small feat. Competitors are constantly pushing the boundaries, and TSMC must continue to innovate to maintain its lead.

That said, TSMC’s track record of innovation gives investors confidence in their ability to adapt and thrive. Their massive R&D budget ensures that they’re always working on the next big breakthrough, making TSM stock a relatively safe bet in the tech space.

Financial Health and Sustainability

Strong Financials

When you look at TSMC’s financials, it’s easy to see why TSM stock is such a popular choice among investors. The company boasts a strong balance sheet, with consistent revenue growth and healthy profit margins. In the most recent quarter, TSMC reported a revenue increase of over 20%, with net income rising by a similar margin.

What’s more, TSMC’s cash flow is robust, allowing them to invest heavily in R&D and capital expenditures. This ensures that they can continue to innovate and expand their operations, further solidifying their position in the market.

Sustainability Initiatives

TSMC is also committed to sustainability, which is becoming an increasingly important factor for investors. The company has set ambitious goals to reduce its carbon footprint and increase the use of renewable energy in its operations. They’ve already made significant progress in this area, and their commitment to sustainability aligns with the values of many modern investors.

By investing in TSM stock, you’re not only supporting a financially strong company but also one that’s dedicated to making a positive impact on the environment.

How to Invest in TSM Stock

Choosing the Right Broker

If you’re ready to jump into TSM stock, the first step is choosing the right broker. There are plenty of options out there, but it’s important to choose one that offers low fees and a user-friendly platform. Some popular brokers for investing in TSM stock include Interactive Brokers, TD Ameritrade, and Charles Schwab.

Once you’ve selected a broker, the process of buying TSM stock is relatively straightforward. Simply create an account, fund it with the amount you want to invest, and place your order. It’s as easy as that.

Building a Diversified Portfolio

While TSM stock is a great investment opportunity, it’s important to remember the importance of diversification. No single stock, no matter how strong, should make up the entirety of your portfolio. By diversifying your investments across different sectors and asset classes, you can reduce risk and increase your chances of long-term success.

Consider pairing TSM stock with other tech stocks, as well as investments in other industries. This will help ensure that your portfolio is well-rounded and capable of weathering any market fluctuations.

Conclusion

Investing in TSM stock is more than just buying a piece of a company; it’s about being part of a movement that’s driving technological innovation forward. From its leadership in the semiconductor industry to its commitment to sustainability, TSMC offers a unique opportunity for investors to benefit from the ongoing digital transformation.

While there are risks to consider, TSMC’s strong financials, dominant market position, and focus on innovation make it a compelling choice for long-term investors. Whether you’re a seasoned pro or just starting out, TSM stock is worth a closer look.

So, what are you waiting for? Dive into the world of TSM stock and see for yourself why it’s one of the most exciting investments in the tech space today. And don’t forget to share your thoughts in the comments below or check out some of our other articles for more insights on the stock market.

Table of Contents

- Understanding the Basics of TSM Stock

- Key Factors Driving TSM Stock Growth

- TSM Stock Performance and Market Trends

- Investor Sentiment and Analyst Outlook

- Risks and Challenges

- Financial Health and Sustainability

- How to Invest in TSM Stock

- Conclusion