So, you've probably heard the buzz about the Russell 2000 Index, right? But what exactly is it, and why should you care? Well, buckle up because we're diving deep into this financial powerhouse that's got everyone talking. Whether you're a seasoned investor or just starting out, understanding the Russell 2000 Index can be a game-changer for your portfolio. This index is like the pulse of small-cap stocks in the US, and knowing how it works can give you an edge in the market. Let's break it down, shall we?

The Russell 2000 Index isn't just another number on a ticker tape; it's a snapshot of the health of small companies in the US economy. Think of it as a barometer for the little guys who are often overshadowed by the big names in the Dow Jones and S&P 500. But don't let its size fool you—these small-cap stocks pack a punch and can offer some serious growth potential. Keep reading to find out why this index is a must-watch for anyone serious about investing.

Now, before we get into the nitty-gritty, let me set the stage for you. The Russell 2000 Index is a part of the broader Russell 3000 Index, which represents approximately 98% of the investable US equity market. The Russell 2000 focuses specifically on the smallest 2,000 companies in that group. It's like the underdog section of the stock market, and sometimes, the underdog can surprise you with its performance. So, let's dive in and see what makes this index tick.

Read also:Hyungry Replacement A Trend Thats Changing The Game

What Exactly is the Russell 2000 Index?

Alright, let's get down to business. The Russell 2000 Index is essentially a collection of 2,000 small-cap stocks that represent the smaller companies in the US stock market. It was created by FTSE Russell back in 1984 and has since become a benchmark for small-cap performance. But why does it matter? Well, these smaller companies often have more growth potential compared to their larger counterparts. Think of it as investing in startups before they hit the big time.

Here's the deal: the Russell 2000 Index is reconstituted annually, meaning the list of companies can change every year. This ensures that it stays relevant and continues to reflect the current state of small-cap stocks. It's like a living, breathing organism that evolves with the market. And guess what? It's also used as a benchmark for mutual funds and ETFs that focus on small-cap stocks. So, if you're looking to invest in this space, the Russell 2000 is a great place to start.

Why Should You Care About the Russell 2000 Index?

Now, you might be wondering, "Why should I care about a bunch of small companies?" Here's the thing: small-cap stocks can offer higher returns compared to large-cap stocks. They're like the hidden gems of the stock market, and the Russell 2000 Index helps you find them. Plus, these companies are often more nimble and can adapt quickly to changes in the market. It's like having a fleet of speedboats instead of a giant cruise ship.

Another reason to pay attention is diversification. Adding small-cap stocks to your portfolio can help balance out the risks associated with larger companies. Think of it as spreading your bets across different sectors and sizes. And let's not forget the potential for growth. These smaller companies have room to expand and can deliver impressive returns if they hit the right stride. So, if you're looking to spice up your investment strategy, the Russell 2000 Index could be your ticket to big gains.

How the Russell 2000 Index Works

Okay, so now that you know what the Russell 2000 Index is, let's talk about how it actually works. It's all about market capitalization, which is basically the total value of a company's outstanding shares. The Russell 2000 focuses on the smallest 2,000 companies in the Russell 3000 Index, which is a broader measure of the US stock market.

Here's the kicker: the Russell 2000 is weighted by market capitalization, meaning the companies with the largest market caps have the biggest influence on the index. But don't worry, it's not just about size. The index also considers other factors like liquidity and financial health to ensure it's a well-rounded representation of small-cap stocks. It's like picking a team where everyone has a role to play, but some players have a bigger impact on the game.

Read also:Underss The Ultimate Guide To Unveiling The Hidden Gems Of Streetwear

Key Features of the Russell 2000 Index

- Market Representation: The Russell 2000 Index covers a wide range of industries and sectors, giving you a comprehensive view of the small-cap market.

- Reconstitution: As I mentioned earlier, the index is reconstituted annually, which means it stays fresh and relevant. It's like a yearly update to ensure it reflects the current market conditions.

- Growth Potential: Small-cap stocks often have more room to grow compared to their larger counterparts. This can translate into higher returns for investors who are willing to take on a bit more risk.

- Diversification: By including a variety of companies across different sectors, the Russell 2000 Index offers a level of diversification that can help mitigate risk in your portfolio.

Historical Performance of the Russell 2000 Index

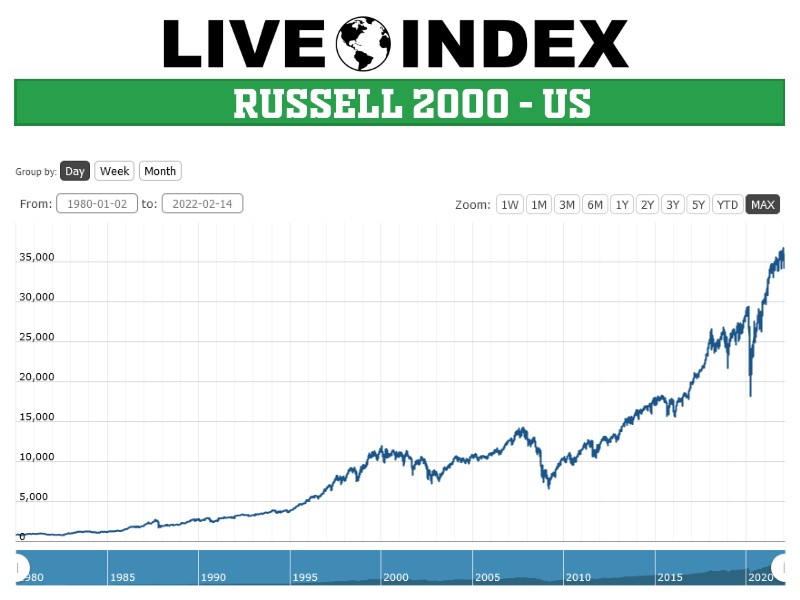

Let's talk numbers, shall we? The historical performance of the Russell 2000 Index is a mixed bag, but overall, it's been pretty solid. Over the past few decades, it's delivered an average annual return of around 9.6%, which is pretty impressive when you consider the volatility of small-cap stocks. But here's the thing: past performance is no guarantee of future results. The market can be unpredictable, and small-cap stocks are no exception.

One interesting fact is that the Russell 2000 Index tends to outperform during economic recoveries. This is because smaller companies are often more agile and can adapt quickly to changes in the market. However, during economic downturns, they can be more vulnerable. It's like a rollercoaster ride, but with the potential for big rewards if you time it right.

Factors Affecting the Russell 2000 Index

There are several factors that can affect the performance of the Russell 2000 Index. Here are a few to keep in mind:

- Economic Conditions: The health of the overall economy can have a big impact on small-cap stocks. When the economy is strong, these companies tend to thrive. But when things get rocky, they can take a hit.

- Interest Rates: Changes in interest rates can affect borrowing costs for small companies, which can impact their bottom line. Lower rates can be a boon, while higher rates can be a burden.

- Market Sentiment: Investor sentiment can also play a role. If investors are optimistic about the future, they may be more willing to invest in small-cap stocks. Conversely, if they're feeling cautious, they might pull back.

Investing in the Russell 2000 Index

So, you're convinced that the Russell 2000 Index is worth your attention. Now, how do you invest in it? There are a few ways to get exposure to this index. You can invest in mutual funds or ETFs that track the Russell 2000, or you can pick individual stocks from the index. It all depends on your investment goals and risk tolerance.

Mutual funds and ETFs are a great way to get broad exposure to the index without having to pick individual stocks. They offer diversification and professional management, which can be a big plus for novice investors. Plus, they're generally more liquid than individual stocks, meaning you can buy and sell them more easily.

Choosing the Right Investment Vehicle

When it comes to investing in the Russell 2000 Index, there are a few things to consider. First, think about your investment goals. Are you looking for growth, income, or a mix of both? Next, consider your risk tolerance. Small-cap stocks can be more volatile, so if you're risk-averse, you might want to tread carefully.

Also, don't forget about fees. Mutual funds and ETFs can have different expense ratios, so it's important to shop around and find the best deal. And finally, consider the tax implications. Some investment vehicles may be more tax-efficient than others, so it's worth doing your homework before you dive in.

Benefits and Risks of Investing in the Russell 2000 Index

Now, let's weigh the pros and cons of investing in the Russell 2000 Index. On the plus side, you get exposure to a diverse group of small-cap stocks that have the potential for significant growth. It's like having a piece of the next big thing before it hits the mainstream. Plus, the index offers diversification across different sectors, which can help mitigate risk.

But there are risks to consider, too. Small-cap stocks can be more volatile than large-cap stocks, which means they can experience bigger swings in price. This can be a double-edged sword—big gains, but also big losses if things go south. And let's not forget about liquidity. Some small-cap stocks may be harder to buy and sell, which can be a problem if you need to liquidate your holdings quickly.

Managing Risk in Your Portfolio

So, how do you manage the risks associated with investing in the Russell 2000 Index? One way is through diversification. Don't put all your eggs in one basket—spread your investments across different asset classes and sectors. This can help cushion the blow if one part of your portfolio takes a hit.

Another strategy is to use dollar-cost averaging. This involves investing a fixed amount of money at regular intervals, regardless of market conditions. It's like smoothing out the bumps in the road by buying more shares when prices are low and fewer shares when prices are high. And finally, don't forget to review your portfolio regularly. Markets change, and your investment strategy should evolve with them.

Comparing the Russell 2000 Index to Other Indices

Now, let's compare the Russell 2000 Index to other popular indices like the S&P 500 and the Dow Jones Industrial Average. The S&P 500 focuses on large-cap stocks, while the Dow Jones is a price-weighted index that includes 30 blue-chip companies. The Russell 2000, on the other hand, is all about small-cap stocks.

Here's the thing: the Russell 2000 can offer higher returns compared to the S&P 500 and the Dow Jones, but it also comes with higher risk. It's like choosing between a steady paycheck and a lottery ticket. The S&P 500 and the Dow Jones may be more stable, but the Russell 2000 has the potential for bigger gains. It all depends on your investment goals and risk tolerance.

Which Index is Right for You?

Deciding which index is right for you depends on several factors. If you're looking for stability and predictability, the S&P 500 or the Dow Jones might be a better fit. But if you're willing to take on more risk for the chance of higher returns, the Russell 2000 could be the way to go. It's all about finding the right balance between risk and reward in your portfolio.

Conclusion

So, there you have it—a comprehensive guide to the Russell 2000 Index. Whether you're a seasoned investor or just starting out, understanding this index can be a valuable tool in your investment strategy. It offers exposure to small-cap stocks that have the potential for significant growth, but it also comes with its own set of risks.

Remember, the key to successful investing is doing your homework and staying informed. Keep an eye on market conditions, economic indicators, and company performance. And don't forget to diversify your portfolio to manage risk. With the right strategy, the Russell 2000 Index could be your ticket to big gains in the stock market.

Now, it's your turn. Have you invested in the Russell 2000 Index? What's your experience been like? Leave a comment below and let's start a conversation. And if you found this article helpful, don't forget to share it with your friends and family. Investing is all about knowledge, and the more we share, the better off we all are. Happy investing, and may the odds be ever in your favor!

Table of Contents

- What Exactly is the Russell 2000 Index?

- Why Should You Care About the Russell 2000 Index?

- How the Russell 2000