Let’s be real here—Google stock price isn’t just a number on a screen. It’s a reflection of one of the most powerful companies in the world. Whether you’re an investor looking to dip your toes into the tech waters or a curious mind trying to understand the pulse of Silicon Valley, this topic deserves your attention. From its humble beginnings as a search engine to becoming a global powerhouse, Google’s stock price has been a rollercoaster ride filled with ups and downs. So buckle up, because we’re diving deep into the world of Google’s financials.

Now, you might be wondering, why should you care about Google stock price? Well, here’s the deal: Google, or Alphabet Inc. as it’s officially known, is more than just a search engine. It’s a conglomerate that owns everything from YouTube to Android to Waymo. When you invest in Google, you’re not just buying a piece of a company—you’re investing in innovation, technology, and the future of digital transformation.

But hey, don’t just take my word for it. In this guide, we’re going to break it all down for you. From understanding how Google stock price works to analyzing trends and making smart investment decisions, we’ve got you covered. So grab a coffee, get comfy, and let’s unravel the mysteries of Google’s financial empire together.

Read also:Tickzoo Your Ultimate Companion For Wildlife Adventures

Understanding the Basics: What Is Google Stock Price?

Alright, let’s start with the basics. The Google stock price is essentially the cost of one share of Alphabet Inc. stock. Now, here’s the kicker—Google operates under a multi-class share structure. This means there are different types of shares, each with its own set of rights and privileges. The two main classes you need to know about are Class A and Class C shares. Class A shares come with voting rights, while Class C shares don’t. Got it? Good.

But why does the Google stock price matter? Well, it’s like the thermometer of the company’s financial health. A rising stock price usually indicates strong performance, while a falling price might signal trouble. Investors use stock prices to gauge the market’s perception of a company’s future prospects. And let’s face it, when it comes to Google, the world is always watching.

Breaking Down the Multi-Class Structure

- Class A Shares: These are the ones you probably hear about the most. They come with voting rights, meaning shareholders get a say in major company decisions.

- Class C Shares: These are also publicly traded, but they don’t come with voting rights. They’re often referred to as “non-voting” shares.

- Class B Shares: These are mostly owned by insiders and founders. They carry even more voting power than Class A shares, but they’re not available to the public.

Understanding these differences is crucial if you’re planning to invest in Google. Each class behaves differently in the market, so knowing what you’re buying is key to making informed decisions.

Historical Performance: A Walk Down Memory Lane

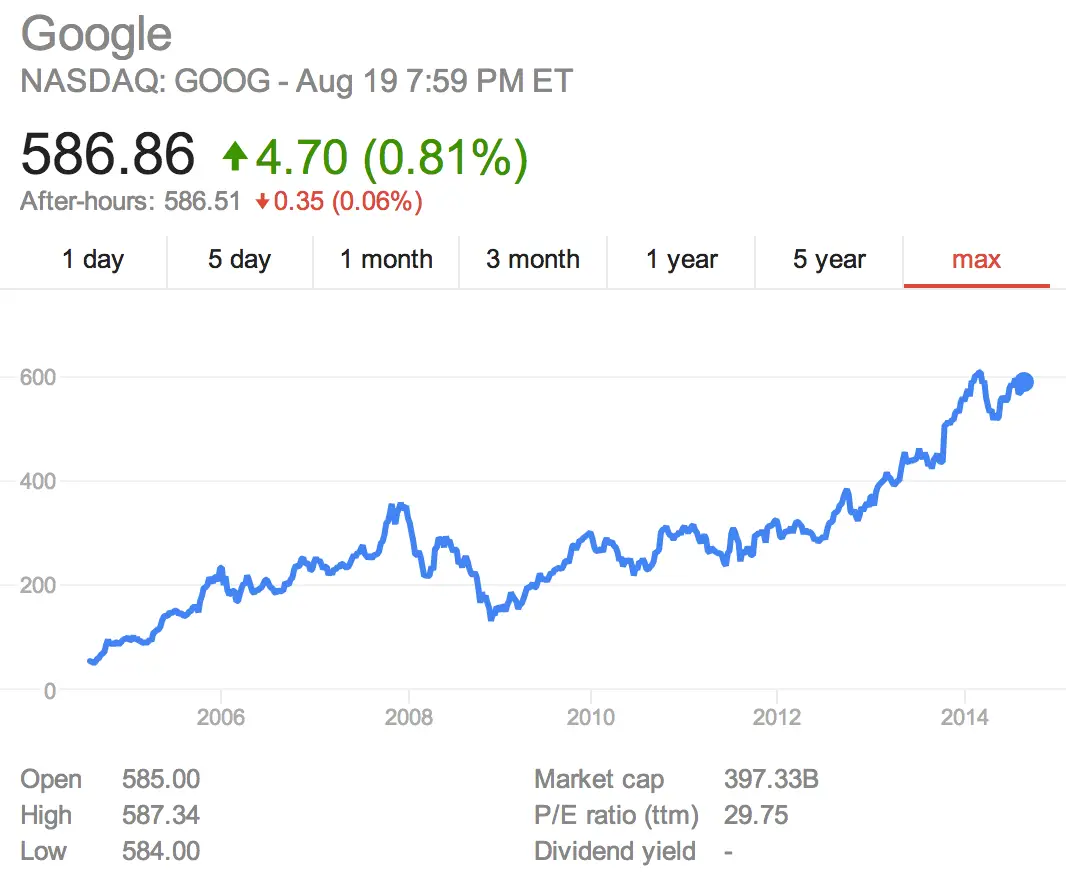

Let’s take a trip back in time to see how Google stock price has evolved over the years. When Google first went public in 2004, its IPO price was set at $85 per share. Fast forward to today, and those shares are worth way more. But it hasn’t been a straight line up. There have been bumps along the way, driven by factors like economic downturns, regulatory challenges, and shifts in consumer behavior.

One of the most significant moments in Google’s stock history was the 2022 stock split. Alphabet announced a 20-for-1 split, which made shares more accessible to individual investors. This move sent ripples through the market and sparked a renewed interest in Google stock.

Key Milestones in Google Stock Price History

- 2004 IPO: Google goes public at $85 per share.

- 2015 Reorganization: Google restructures into Alphabet Inc., leading to a surge in stock price.

- 2022 Stock Split: A 20-for-1 split makes shares more affordable for retail investors.

These milestones are more than just numbers. They represent strategic decisions that have shaped Google’s financial journey. And as an investor, understanding these moments can give you valuable insights into the company’s growth trajectory.

Read also:Chris Williamson The Rising Star Redefining Music With Passion And Talent

Factors Influencing Google Stock Price

So, what makes Google stock price tick? Like any other company, Google’s stock price is influenced by a variety of factors. Some are internal, like earnings reports and product launches. Others are external, such as market trends and geopolitical events. Let’s break it down.

Internal Factors

- Earnings Reports: When Google reports strong quarterly earnings, its stock price tends to rise. Conversely, a miss on revenue or profit expectations can send shares tumbling.

- Product Innovation: Google is all about innovation. Every time it launches a new product or service, it can have a significant impact on its stock price.

- Management Decisions: The leadership team plays a crucial role in shaping the company’s direction. Strategic moves like acquisitions or restructuring can influence investor sentiment.

External Factors

- Market Trends: The tech sector is highly volatile. Any shift in market sentiment can affect Google’s stock price.

- Regulatory Environment: With antitrust scrutiny increasing globally, regulatory decisions can have a profound impact on Google’s operations and stock price.

- Economic Conditions: Economic downturns or recoveries can influence investor confidence, affecting stock prices across the board.

Understanding these factors is key to predicting how Google stock price might behave in the future. It’s like reading tea leaves, but with data and analysis instead of mystical vibes.

How to Analyze Google Stock Price Trends

Alright, now that we know what influences Google stock price, let’s talk about how to analyze it. There are several tools and techniques you can use to get a clearer picture of where Google’s stock is headed.

Technical Analysis

Technical analysis involves studying historical price movements and chart patterns to predict future trends. Traders use indicators like moving averages, relative strength index (RSI), and Bollinger Bands to identify potential buy or sell signals. For example, if Google’s stock price breaks above a key resistance level, it might indicate an upward trend.

Fundamental Analysis

Fundamental analysis, on the other hand, looks at the company’s financial health and business operations. Key metrics like revenue growth, profit margins, and cash flow are critical in evaluating Google’s long-term potential. Analysts also consider factors like market share, competitive landscape, and technological advancements when assessing the company’s value.

By combining both technical and fundamental analysis, you can get a more comprehensive view of Google stock price trends. It’s like having a GPS for your investment journey.

Investing in Google Stock: Is It Worth It?

Now, the million-dollar question—should you invest in Google stock? The answer, as with most things in life, depends on your goals and risk tolerance. Google has a proven track record of delivering strong returns, but like any investment, it comes with risks.

Pros of Investing in Google Stock

- Strong Financial Performance: Google consistently reports solid earnings, driven by its diverse revenue streams.

- Innovation Leadership: As a leader in technology, Google is always pushing the boundaries of what’s possible.

- Global Reach: With products and services used by billions of people worldwide, Google has a massive market presence.

Cons of Investing in Google Stock

- Regulatory Risks: Antitrust investigations and other legal challenges could impact Google’s operations.

- Market Volatility: The tech sector is known for its ups and downs, and Google’s stock price can be affected by broader market trends.

- Valuation Concerns: With a high price-to-earnings (P/E) ratio, some analysts argue that Google’s stock might be overvalued.

At the end of the day, investing in Google stock is a personal decision. It’s important to do your research, assess your risk tolerance, and consult with a financial advisor if needed.

Google Stock Price Forecast: What the Experts Say

So, what do the experts think about Google stock price in the future? Analysts are generally bullish, citing Google’s strong fundamentals and growth prospects. Many predict that the stock could continue to rise, driven by factors like digital advertising growth, cloud computing expansion, and advancements in artificial intelligence.

However, it’s important to take forecasts with a grain of salt. The stock market is unpredictable, and even the best analysts can’t see the future. That’s why diversification and a long-term perspective are key to successful investing.

Key Predictions for Google Stock Price

- Increased Focus on AI: As Google ramps up its AI efforts, it could open up new revenue streams and drive stock price higher.

- Cloud Computing Growth: With more businesses moving to the cloud, Google Cloud could become a major growth driver.

- Regulatory Challenges: While the company faces antitrust scrutiny, its ability to innovate and adapt could mitigate potential risks.

These predictions provide a glimpse into what the future might hold for Google stock price. But remember, the market is always evolving, and staying informed is the best way to navigate it.

Conclusion: Your Next Steps in the World of Google Stock Price

Well, there you have it—a deep dive into the world of Google stock price. From understanding the basics to analyzing trends and making informed decisions, we’ve covered a lot of ground. Google stock price isn’t just a number—it’s a reflection of a company that’s shaping the future of technology and innovation.

Before we wrap up, here’s a quick recap of the key points we’ve discussed:

- Google operates under a multi-class share structure, with Class A and Class C shares available to the public.

- The company’s stock price has seen significant growth since its IPO in 2004, with key milestones like the 2022 stock split making shares more accessible.

- Factors influencing Google stock price include earnings reports, product innovation, market trends, and regulatory challenges.

- Investors can use technical and fundamental analysis to better understand Google stock price trends.

- While investing in Google stock comes with risks, its strong fundamentals and growth prospects make it an attractive option for many investors.

Now, it’s your turn to take action. Whether you’re ready to buy Google stock or just want to keep an eye on its performance, staying informed is the key to success. So, leave a comment, share this article with your friends, or dive deeper into the world of finance. The choice is yours, but one thing’s for sure—Google stock price is a topic worth watching.

Table of Contents

- Understanding the Basics: What Is Google Stock Price?

- Historical Performance: A Walk Down Memory Lane

- Factors Influencing Google Stock Price

- How to Analyze Google Stock Price Trends

- Investing in Google Stock: Is It Worth It?

- Google Stock Price Forecast: What the Experts Say

- Conclusion: Your Next Steps in the World of Google Stock Price