Ever wonder how decisions made behind closed doors can affect your wallet? Fed meeting is where the magic happens, shaping the financial landscape for everyone from Wall Street tycoons to everyday Joe. Think of it as the central nervous system of the US economy – one small move, and the entire market feels the ripple effects. So, buckle up, because we're diving deep into the world of Federal Reserve meetings and uncovering the secrets that make them so crucial.

Now, you might be asking, "What exactly is a fed meeting?" Well, it's like a super important gathering of financial wizards who sit around a table, crunch numbers, and decide the fate of interest rates and monetary policies. These meetings are held by the Federal Open Market Committee (FOMC), a group within the Federal Reserve System that has the power to make decisions that impact the entire economy.

But why should you care? Let me tell you, friend, these meetings can influence everything from mortgage rates to stock prices. If you're thinking about buying a house, investing in the stock market, or even just saving up for a rainy day, understanding what happens during these meetings can give you a leg up in navigating the financial world.

Read also:Faith Hill 2025 The Queen Of Country Music Still Shining Bright

What Exactly Happens During a Fed Meeting?

So, you're curious about the nitty-gritty details of a fed meeting? Well, picture this: a bunch of economists, policymakers, and central bankers sitting in a room, sipping coffee, and discussing the state of the economy. It's not as glamorous as it sounds, but trust me, the decisions they make have far-reaching consequences.

During these meetings, the FOMC reviews economic data, analyzes market trends, and debates the best course of action to keep the economy running smoothly. They discuss things like inflation rates, unemployment numbers, and GDP growth. It's like a big puzzle, and they're trying to figure out which pieces fit where to create a picture of economic stability.

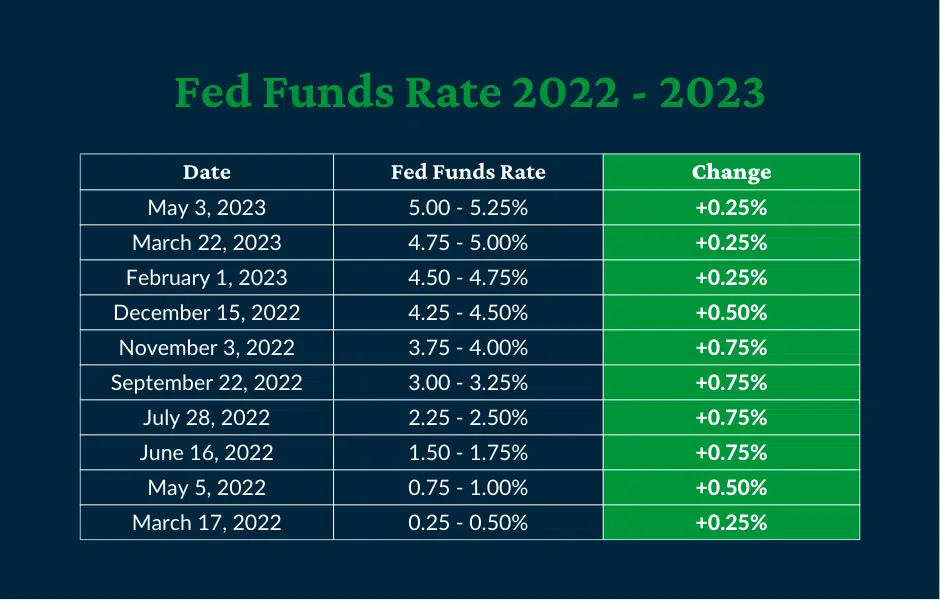

One of the most important things they decide is whether to raise, lower, or keep interest rates the same. This decision can have a huge impact on borrowing costs for businesses and consumers alike. If they raise rates, borrowing becomes more expensive, which can slow down economic growth. If they lower rates, borrowing becomes cheaper, which can stimulate the economy.

Key Players in the Fed Meeting

Now, let's talk about the people behind the curtain. The FOMC is made up of 12 members, including the seven members of the Board of Governors of the Federal Reserve System and five of the 12 Federal Reserve Bank presidents. These folks are the decision-makers, and their expertise and experience are crucial in shaping the outcome of the meetings.

Among these key players is the Chair of the Federal Reserve, who leads the discussions and has a significant influence on the decisions made. The current Chair, Jerome Powell, has been at the helm since 2018 and has navigated some pretty turbulent waters, including the economic fallout from the pandemic.

But it's not just about the bigwigs. Each member brings their own perspective and insights to the table, and the diversity of thought is what makes these meetings so dynamic. They debate, they argue, and eventually, they come to a consensus on the best path forward.

Read also:Kerrilee Kaski The Rising Star Whorsquos Making Waves In Hollywood

Why Fed Meeting Matters to You

Alright, let's get real for a second. Why should you, the average person, care about what happens in a fed meeting? Well, because it affects your life in ways you might not even realize. Think about it – when the Fed raises interest rates, it becomes more expensive to borrow money. That means if you're planning to buy a house, take out a car loan, or even use your credit card, you're going to feel the pinch.

On the flip side, when the Fed lowers interest rates, borrowing becomes cheaper, which can be a boon for those looking to invest in property or start a business. It's like a seesaw – one side goes up, the other goes down, and you're sitting right in the middle of it all.

And let's not forget about the stock market. Traders and investors closely watch fed meetings because they can signal changes in monetary policy that can send stocks soaring or plummeting. If the Fed hints at raising rates, the market might react negatively, causing stock prices to drop. Conversely, if they signal a rate cut, the market might rally in response.

Impact on Global Markets

But the influence of fed meetings doesn't stop at the US border. The decisions made by the FOMC have a ripple effect on global markets. When the US economy sneezes, the rest of the world catches a cold, so to speak. That's because the US dollar is the world's reserve currency, and many countries peg their own currencies to it.

For example, if the Fed raises interest rates, it can strengthen the dollar, making it more attractive to foreign investors. This can lead to capital flowing out of emerging markets and into the US, causing currency depreciation and economic instability in those countries. It's a delicate balancing act, and the Fed has to consider the global impact of its decisions.

How to Prepare for Fed Meeting Announcements

So, you want to be prepared for the next fed meeting announcement? Good idea. Here's a quick rundown of what you can do to stay ahead of the curve:

- Stay Informed: Keep an eye on the economic calendar and mark the dates of upcoming fed meetings. There are eight scheduled meetings each year, so you'll have plenty of opportunities to tune in.

- Follow the Experts: Listen to financial analysts and economists who can provide insights and predictions about what the Fed might do. They can help you understand the context and potential implications of the decisions.

- Review Economic Indicators: Pay attention to key economic indicators like inflation rates, employment numbers, and GDP growth. These are the data points the Fed uses to make its decisions, so being aware of them can give you a better understanding of what to expect.

By staying informed and prepared, you can make more informed decisions about your finances and investments. It's like having a crystal ball that gives you a glimpse into the future of the economy.

Common Misconceptions About Fed Meetings

There are a lot of myths and misconceptions floating around about fed meetings. Let's debunk a few of them:

- Myth: The Fed controls the stock market. While the Fed's decisions can influence the market, they don't have direct control over it. The stock market is driven by a multitude of factors, including investor sentiment, company earnings, and global events.

- Myth: The Fed always knows what it's doing. Let's face it, even the best economists can't predict the future with 100% accuracy. The Fed operates in a constantly changing environment and has to make decisions based on the best available information at the time.

- Myth: Fed meetings are secret and hidden from the public. On the contrary, the Fed is one of the most transparent central banks in the world. They release detailed minutes of their meetings and provide statements explaining their decisions.

Understanding these misconceptions can help you better interpret the information coming out of fed meetings and make more rational decisions.

Historical Context of Fed Meetings

Let's take a trip down memory lane and look at some of the most significant fed meetings in history. These meetings have had a lasting impact on the economy and shaped the course of financial history.

One of the most notable fed meetings occurred in 2008 during the height of the financial crisis. The Fed slashed interest rates to near zero and embarked on a program of quantitative easing to inject liquidity into the market. This bold move helped stabilize the economy and prevent a total collapse.

Another pivotal moment came in 2015 when the Fed raised interest rates for the first time since the crisis. It was a signal that the economy was strong enough to withstand higher borrowing costs and marked the beginning of a new era of monetary policy.

By understanding the historical context of fed meetings, you can gain a deeper appreciation for the role they play in shaping the economy and the decisions that have been made in the past.

Lessons Learned from Past Fed Meetings

What can we learn from these historical fed meetings? Plenty, actually. Here are a few key takeaways:

- Flexibility is Key: The Fed has shown that it's willing to adapt its policies to meet the needs of the economy. Whether it's cutting rates to near zero or raising them to control inflation, flexibility is essential in navigating economic challenges.

- Communication Matters: Clear and transparent communication from the Fed can help manage expectations and reduce market volatility. When the Fed speaks, the world listens, and for good reason.

- Long-Term Thinking is Important: The Fed doesn't make decisions based on short-term market fluctuations. They take a long-term view of the economy and focus on sustainable growth and stability.

These lessons can guide us in understanding the decisions the Fed makes today and how they fit into the broader economic landscape.

Future of Fed Meetings

So, what does the future hold for fed meetings? As the economy continues to evolve and new challenges arise, the Fed will have to adapt its strategies and approaches. One of the biggest challenges facing the Fed today is navigating the post-pandemic recovery and addressing issues like inflation and labor market dynamics.

There's also the question of how the Fed will handle the normalization of monetary policy. After years of near-zero interest rates and quantitative easing, the Fed will eventually have to raise rates and reduce its balance sheet. This process will require careful planning and execution to avoid disrupting the market.

Looking ahead, the Fed will continue to play a crucial role in shaping the economic landscape. By staying informed and understanding the factors influencing their decisions, you can better prepare for the future and make informed financial decisions.

Preparing for Uncertainty

Uncertainty is a constant in the world of finance, and fed meetings are no exception. As we move forward, it's important to be prepared for the unexpected. Here are a few tips to help you navigate the uncertainty:

- Stay Diversified: Diversification is key to managing risk in your investment portfolio. By spreading your investments across different asset classes, you can reduce the impact of any one market movement.

- Focus on the Long-Term: Don't get caught up in short-term market fluctuations. Keep your eyes on your long-term financial goals and stay the course.

- Consult with Experts: If you're feeling uncertain about the future, don't hesitate to seek advice from financial professionals who can provide guidance and support.

By adopting these strategies, you can better prepare for the uncertainty that lies ahead and make informed decisions about your finances.

Conclusion: Why Fed Meetings Matter

In conclusion, fed meetings are a crucial component of the US economy and have far-reaching implications for individuals, businesses, and global markets. Understanding what happens during these meetings and how they affect the economy can empower you to make better financial decisions.

From influencing interest rates and monetary policy to impacting stock prices and global markets, the decisions made by the FOMC have a profound effect on the financial landscape. By staying informed, preparing for announcements, and learning from the past, you can navigate the uncertainty and make the most of the opportunities that arise.

So, the next time you hear about a fed meeting, don't tune it out. Pay attention, because the decisions made behind those closed doors could very well affect your wallet. And who knows, you might just impress your friends at the next dinner party with your newfound knowledge of the Federal Reserve.

Call to Action

Now it's your turn. Share your thoughts and insights in the comments below. Do you have any questions about fed meetings or the economy? Or maybe you have some tips for staying ahead of the curve? Let's start a conversation and keep the learning going.

And don't forget to check out our other articles for more insights into the world of finance and economics. Knowledge is power, and the more you know, the better equipped you'll be to navigate the ever-changing financial landscape.

Until next time, stay curious, stay informed, and most importantly, stay ahead of the game.

Table of Contents

- What Exactly Happens During a Fed Meeting?

- Key Players in the Fed Meeting

- Why Fed Meeting Matters to You

- Impact on Global Markets

- How to Prepare for Fed Meeting Announcements

- Common Misconceptions About Fed Meetings