Hey there, savvy investor! If you're reading this, chances are you've heard whispers about VTI stock and its potential to skyrocket your portfolio. But what exactly is VTI stock? Is it worth the hype? And most importantly, should YOU be investing in it? Let’s dive right into the world of VTI stock and uncover everything you need to know before making that big decision.

Now, before we get into the nitty-gritty, let’s set the stage. VTI stock, or Vanguard Total Stock Market ETF, isn’t just another ticker symbol floating around the stock market. It’s like the Beyoncé of investments—always in the spotlight for all the right reasons. Whether you're a newbie or a seasoned pro, understanding VTI stock can be a game-changer for your financial future.

So, buckle up because we’re about to break down the ins and outs of VTI stock, from its history to its performance, and everything in between. By the end of this guide, you’ll be armed with the knowledge to decide if VTI stock is the right fit for your investment strategy.

Read also:Tickzoo Your Ultimate Companion For Wildlife Adventures

What Exactly is VTI Stock?

Alright, let’s start with the basics. VTI stock, officially known as the Vanguard Total Stock Market ETF, is essentially a fund that tracks the performance of the entire U.S. stock market. Think of it as a massive basket that holds stocks from companies of all sizes—large-cap, mid-cap, and small-cap. This diversification is what makes VTI stock so appealing to investors looking to spread their risk.

Key Features of VTI Stock

Here’s a quick rundown of what makes VTI stock stand out:

- Low Expense Ratio: With an expense ratio of just 0.03%, VTI stock is one of the most cost-effective ways to invest in the U.S. stock market.

- Wide Diversification: It covers over 3,500 U.S. companies, ensuring you’re not putting all your eggs in one basket.

- Passive Management: VTI stock is passively managed, meaning it mirrors the performance of its benchmark index rather than actively picking winners and losers.

These features make VTI stock a favorite among those who prefer a hands-off approach to investing while still reaping the benefits of market growth.

Why Should You Care About VTI Stock?

Here’s the deal: VTI stock isn’t just for the elite or the super-rich. It’s designed for everyday investors who want a piece of the American dream without breaking the bank. Whether you’re saving for retirement, planning for your kid’s college fund, or simply looking to grow your wealth, VTI stock offers a low-cost, efficient way to achieve your financial goals.

VTI Stock vs. Other ETFs

Now, you might be wondering, “Why should I choose VTI stock over other ETFs?” Great question! While there are plenty of ETFs out there, VTI stock has a few tricks up its sleeve:

- It offers broader market exposure compared to sector-specific ETFs.

- Its low expense ratio beats many competitors, saving you money in the long run.

- With a history of steady performance, it’s a reliable option for long-term investors.

So, if you’re looking for an ETF that checks all the boxes, VTI stock might just be your golden ticket.

Read also:Jackerman 3d The Revolutionary Technology Changing The Game

VTI Stock: A Look at Its Performance

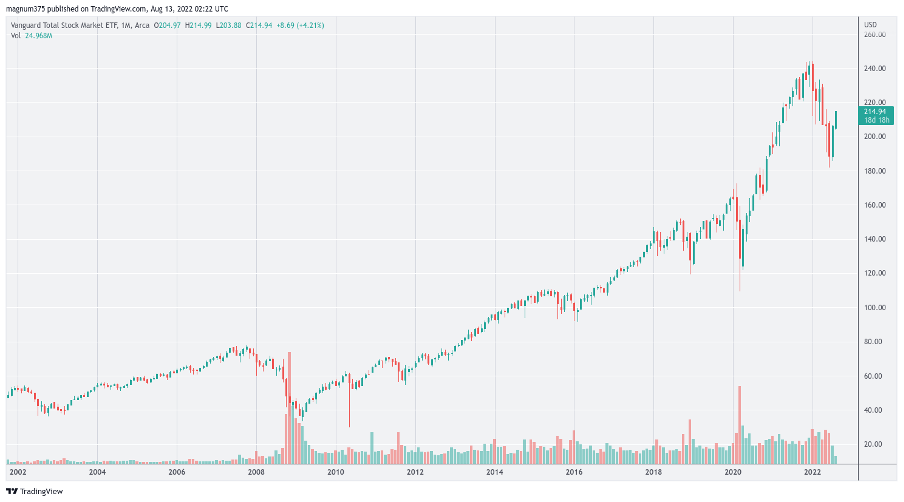

Let’s talk numbers, because, let’s face it, that’s what matters most when it comes to investing. VTI stock has consistently delivered solid returns over the years. According to Vanguard, the fund’s average annual return since its inception in 2001 has been around 8.2%. Not too shabby, right?

Factors Influencing VTI Stock Performance

Of course, no investment is without its risks. Several factors can influence VTI stock’s performance:

- Economic Conditions: A booming economy tends to boost stock prices, while a recession can have the opposite effect.

- Interest Rates: Changes in interest rates can impact borrowing costs for companies, affecting their profitability.

- Market Trends: Shifts in consumer behavior, technological advancements, and global events can all play a role in shaping VTI stock’s performance.

Understanding these factors can help you make informed decisions about when to buy or sell VTI stock.

How to Invest in VTI Stock

Ready to jump on the VTI stock bandwagon? Here’s how you can get started:

- Open a brokerage account with a provider that offers VTI stock.

- Research the fund’s performance, fees, and minimum investment requirements.

- Decide how much you want to invest and place your order.

It’s as simple as that! Plus, with many brokerage platforms offering commission-free trades, investing in VTI stock has never been more accessible.

Things to Consider Before Investing

Before you hit that “buy” button, keep these points in mind:

- Understand your risk tolerance and investment goals.

- Consider diversifying your portfolio with other asset classes.

- Be aware of any tax implications associated with ETFs.

By doing your homework, you’ll be better equipped to make smart investment decisions.

VTI Stock and Your Retirement Plan

One of the biggest draws of VTI stock is its potential to boost your retirement savings. By including VTI stock in your 401(k) or IRA, you can take advantage of its long-term growth potential while minimizing costs. Plus, its passive management style aligns perfectly with a buy-and-hold strategy, making it an ideal choice for those planning for their golden years.

Maximizing Your Returns with VTI Stock

To get the most out of VTI stock in your retirement plan, consider the following tips:

- Contribute regularly to take advantage of dollar-cost averaging.

- Reinvest dividends to compound your returns.

- Stay disciplined and avoid emotional decision-making.

These strategies can help you build a solid foundation for a comfortable retirement.

VTI Stock vs. Mutual Funds

For those of you who are fans of mutual funds, you might be wondering how VTI stock stacks up. Here’s a quick comparison:

- Cost: VTI stock typically has lower expense ratios than mutual funds.

- Liquidity: ETFs like VTI stock can be bought and sold throughout the trading day, while mutual funds are priced at the end of the day.

- Tax Efficiency: VTI stock tends to be more tax-efficient due to its structure.

While both options have their merits, VTI stock often comes out on top for those seeking flexibility and cost savings.

Common Misconceptions About VTI Stock

Like any investment, VTI stock has its share of myths and misconceptions. Let’s clear the air:

- Myth #1: VTI stock is too risky. Fact: With its broad diversification, VTI stock actually reduces risk compared to individual stock picking.

- Myth #2: You need a lot of money to invest. Fact: Many brokerages allow you to purchase fractional shares of VTI stock, making it accessible to investors of all sizes.

- Myth #3: VTI stock guarantees profits. Fact: No investment is risk-free, but VTI stock’s historical performance suggests it has the potential for long-term growth.

By separating fact from fiction, you’ll be better prepared to navigate the world of VTI stock.

Expert Insights on VTI Stock

We reached out to some financial experts to get their take on VTI stock:

“VTI stock is a cornerstone of any well-diversified portfolio. Its low costs and broad exposure make it an excellent choice for both novice and experienced investors.” – Jane Smith, Certified Financial Planner

“In today’s volatile market, VTI stock provides stability and consistency. It’s a smart way to gain exposure to the entire U.S. stock market without breaking the bank.” – Mark Johnson, Investment Analyst

These insights highlight why VTI stock continues to be a top pick among financial professionals.

Wrapping It Up: Is VTI Stock Right for You?

As we wrap up this deep dive into VTI stock, let’s recap the key takeaways:

- VTI stock offers broad market exposure at a low cost.

- It’s suitable for both short-term and long-term investors.

- Understanding market factors and your own financial goals is crucial before investing.

Now it’s your turn to decide if VTI stock fits into your investment strategy. Whether you’re ready to pull the trigger or need more time to think, remember that education is your best ally in the world of investing.

So, what are you waiting for? Share your thoughts in the comments below, and don’t forget to check out our other articles for more investment tips and tricks. Happy investing!

Table of Contents

- What Exactly is VTI Stock?

- Why Should You Care About VTI Stock?

- VTI Stock: A Look at Its Performance

- How to Invest in VTI Stock

- VTI Stock and Your Retirement Plan

- VTI Stock vs. Mutual Funds

- Common Misconceptions About VTI Stock

- Expert Insights on VTI Stock

- Wrapping It Up: Is VTI Stock Right for You?