Let’s get straight to the point: QQQ stock price is something that every investor, whether a beginner or a seasoned pro, should pay attention to. If you’ve ever wondered about what makes QQQ tick and how its price movements can impact your portfolio, you’ve come to the right place. In today’s market, QQQ isn’t just another stock—it’s a powerhouse that holds the key to understanding some of the biggest tech names out there. So, buckle up because we’re diving deep into the world of QQQ and decoding its price dynamics.

Investing in stocks can feel like walking through a maze, but QQQ makes it a little easier. It’s not just any ETF; it’s the Invesco QQQ Trust, which tracks the Nasdaq-100 Index. That means you’re not just buying a single stock—you’re getting a slice of 100 of the largest and most innovative companies in the tech-driven economy. But here’s the kicker: QQQ stock price isn’t just about numbers. It’s about understanding the forces that drive it, from market trends to economic shifts.

Now, if you’re wondering why QQQ has become such a hot topic, it’s simple. In a world where technology dominates every aspect of our lives, QQQ offers exposure to the companies shaping the future. Whether it’s Apple, Microsoft, Amazon, or Tesla, these are the names that define the modern economy. And as an investor, understanding QQQ stock price isn’t just about making money—it’s about staying ahead of the curve.

Read also:Melanie Renee Cade Net Worth The Untold Story You Need To Know

What Exactly is QQQ Stock Price?

QQQ stock price refers to the current market value of a single share in the Invesco QQQ Trust ETF. But let’s break it down a bit more. Think of QQQ as a basket of stocks that includes some of the biggest names in the tech and non-financial sectors. When you buy a share of QQQ, you’re essentially investing in the performance of these companies. The price you pay for that share is influenced by factors like market sentiment, economic conditions, and the performance of the underlying stocks in the Nasdaq-100 Index.

Here’s the thing: QQQ isn’t your typical stock. It’s an ETF, which means it trades like a stock but represents a diversified portfolio. This diversification is one of the reasons why QQQ stock price tends to be more stable compared to individual stocks. However, that doesn’t mean it’s immune to market volatility. In fact, QQQ can be quite sensitive to changes in the tech sector, which makes it both exciting and challenging for investors.

Why Does QQQ Stock Price Matter?

QQQ stock price matters because it reflects the health of the tech-driven economy. When you look at the companies included in the Nasdaq-100, you’re seeing the pulse of innovation. If QQQ is performing well, it’s a sign that these companies are thriving. On the flip side, if the price drops, it could indicate challenges in the tech sector or broader economic concerns.

For individual investors, QQQ stock price is also a barometer of risk and reward. It allows you to tap into the growth potential of tech giants without putting all your eggs in one basket. Plus, with QQQ, you get exposure to sectors like consumer goods, healthcare, and biotech—all wrapped up in one convenient package.

Factors That Influence QQQ Stock Price

Now that we know what QQQ stock price is, let’s talk about the factors that influence it. The market isn’t just a random game of chance—it’s driven by a combination of economic, political, and social forces. Here are some key factors that can impact QQQ:

- Economic Indicators: Interest rates, inflation, and GDP growth can all affect QQQ stock price. For example, if the Federal Reserve raises interest rates, it can lead to a slowdown in tech investments, which might drag QQQ prices down.

- Tech Sector Performance: Since QQQ is heavily weighted toward tech stocks, any major developments in the sector—whether positive or negative—can have a significant impact on its price.

- Global Events: Political tensions, trade wars, or even natural disasters can create uncertainty in the market, leading to fluctuations in QQQ stock price.

- Corporate Earnings: When companies in the Nasdaq-100 report strong earnings, it can boost investor confidence and drive QQQ prices higher. Conversely, poor earnings can have the opposite effect.

These factors aren’t isolated—they work together to shape the trajectory of QQQ stock price. As an investor, it’s important to stay informed and keep an eye on these dynamics to make smarter decisions.

Read also:Sara Duterte Height The Truth Behind The Numbers

How to Track QQQ Stock Price

Tracking QQQ stock price is easier than you might think. Thanks to the internet, there are plenty of tools and platforms that can help you stay on top of its performance. Here are a few options:

- Financial News Websites: Sites like Yahoo Finance, Bloomberg, and CNBC provide real-time updates on QQQ stock price along with analysis and commentary from experts.

- Brokerage Platforms: If you’re already trading, your brokerage account likely offers tools to monitor QQQ. Many platforms also provide alerts so you can stay informed on the go.

- Mobile Apps: Apps like StockTwits, Robinhood, and TD Ameritrade allow you to track QQQ stock price and engage with a community of investors.

Remember, tracking QQQ isn’t just about watching numbers—it’s about understanding the context behind those numbers. By combining data with insights, you can make more informed decisions about your investments.

QQQ Stock Price Historical Performance

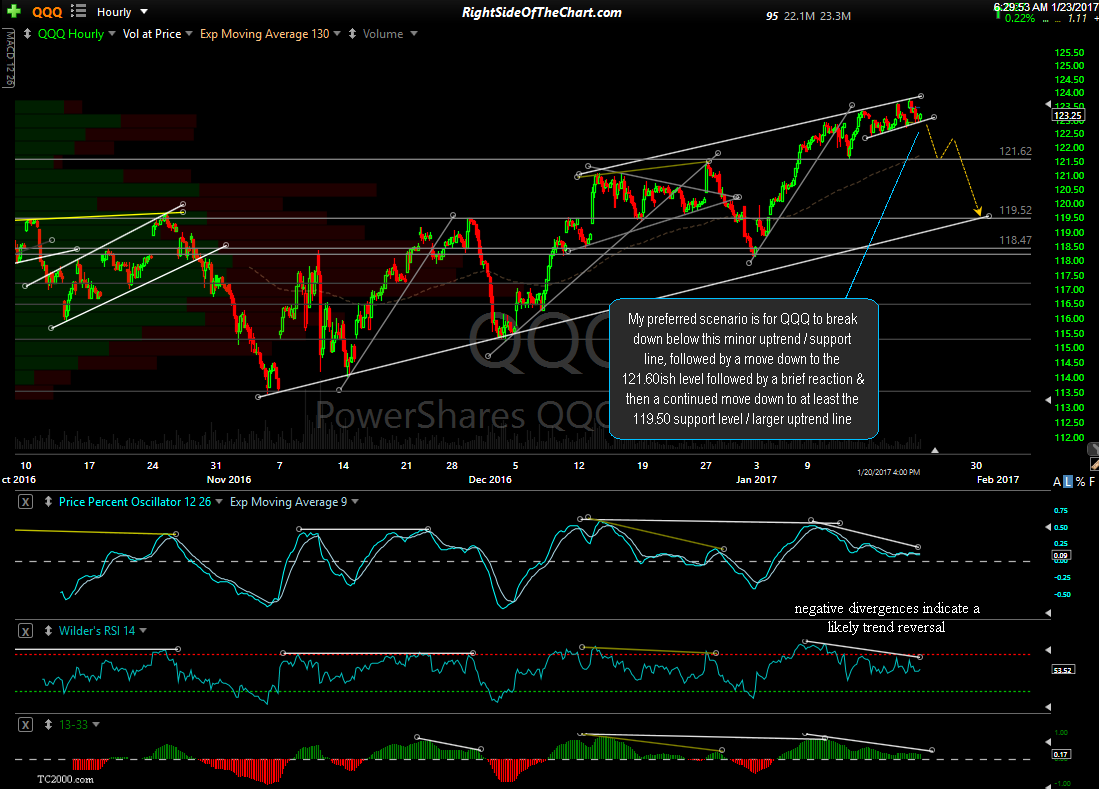

Looking at QQQ stock price over time can give you a clearer picture of its potential. Historically, QQQ has delivered impressive returns, especially during periods of strong economic growth. For instance, during the dot-com boom of the late 1990s, QQQ soared as tech stocks dominated the market. However, it also experienced significant declines during the 2008 financial crisis, highlighting the importance of diversification.

In recent years, QQQ has shown resilience, bouncing back from setbacks and continuing to grow. This is largely due to the strong fundamentals of the companies in the Nasdaq-100. As the global economy becomes increasingly digital, QQQ is well-positioned to benefit from trends like cloud computing, artificial intelligence, and renewable energy.

Key Milestones in QQQ Stock Price History

Here are a few key milestones in the history of QQQ stock price:

- Launch in 1999: QQQ was introduced as the first ETF to track the Nasdaq-100 Index, revolutionizing the way investors approached the market.

- Dot-Com Bubble: QQQ reached its peak during the dot-com boom but suffered a sharp decline when the bubble burst.

- Recovery Post-2008: After the financial crisis, QQQ made a remarkable comeback, driven by the resurgence of tech companies.

- 2020 Pandemic: Despite the initial shock of the pandemic, QQQ quickly rebounded, fueled by the shift to remote work and digital solutions.

These milestones demonstrate the volatility and resilience of QQQ stock price over time. They also highlight the importance of staying informed and adaptable as an investor.

QQQ Stock Price vs. Other ETFs

When it comes to ETFs, QQQ isn’t the only player in town. There are plenty of other options out there, each with its own unique characteristics. So, how does QQQ stack up against the competition? Let’s take a look:

- SPY (SPDR S&P 500 ETF): SPY tracks the S&P 500 Index, offering broader exposure to the U.S. economy. While it includes tech companies, it’s not as heavily weighted toward the sector as QQQ.

- VOO (Vanguard S&P 500 ETF): Similar to SPY, VOO provides diversified exposure to large-cap stocks. However, it tends to have lower fees compared to QQQ.

- XLK (Technology Select Sector SPDR Fund): XLK focuses exclusively on the tech sector, making it a more concentrated play compared to QQQ.

Each ETF has its own strengths and weaknesses, and the best choice depends on your investment goals and risk tolerance. QQQ, with its blend of tech and non-financial stocks, offers a balance that many investors find appealing.

Why Choose QQQ Over Other ETFs?

QQQ stands out for several reasons:

- Innovation Focus: QQQ gives you access to the most innovative companies in the market, positioning you for long-term growth.

- Diversification: While QQQ is heavily weighted toward tech, it also includes companies from other sectors, reducing risk.

- Liquidity: QQQ is one of the most traded ETFs, making it easy to buy and sell shares without worrying about liquidity issues.

Ultimately, choosing QQQ over other ETFs comes down to your personal investment strategy. Whether you’re looking for growth, diversification, or liquidity, QQQ has something to offer.

QQQ Stock Price Forecast: What Lies Ahead?

Predicting the future of QQQ stock price is no easy task, but there are a few trends that could shape its trajectory:

- Tech Dominance: As technology continues to drive economic growth, companies in the Nasdaq-100 are likely to remain at the forefront of innovation.

- Sustainability: Investors are increasingly focused on ESG (Environmental, Social, and Governance) factors, which could benefit companies in the Nasdaq-100 that prioritize sustainability.

- Global Expansion: Many of the companies in QQQ have significant international operations, which could provide additional growth opportunities as global markets expand.

While these trends offer reason for optimism, it’s important to remain cautious. Economic uncertainties, geopolitical tensions, and regulatory changes could all impact QQQ stock price in the coming years. As always, diversification and a long-term perspective are key to navigating the market.

How to Prepare for Future QQQ Stock Price Movements

To prepare for future QQQ stock price movements, consider the following strategies:

- Stay Informed: Keep up with the latest news and developments in the tech sector to better understand what might impact QQQ.

- Diversify Your Portfolio: While QQQ is diversified within the Nasdaq-100, it’s still a good idea to spread your investments across different asset classes.

- Set Realistic Goals: Understand your risk tolerance and set achievable goals for your investments in QQQ.

By taking a proactive approach, you can position yourself to capitalize on opportunities while mitigating potential risks.

Conclusion: Making Sense of QQQ Stock Price

We’ve covered a lot of ground when it comes to QQQ stock price, from understanding its basics to exploring the factors that influence it. One thing is clear: QQQ isn’t just another ETF—it’s a gateway to the companies shaping the future. Whether you’re a tech enthusiast, a growth investor, or simply looking for diversification, QQQ has something to offer.

So, what’s next? If you’ve found this guide helpful, we encourage you to take action. Start tracking QQQ stock price, do your own research, and consider adding it to your portfolio. And don’t forget to share this article with fellow investors who might benefit from the insights. Together, we can navigate the market and build a brighter financial future.

Table of Contents

- Understanding QQQ Stock Price: A Comprehensive Guide for Every Investor

- What Exactly is QQQ Stock Price?

- Why Does QQQ Stock Price Matter?

- Factors That Influence QQQ Stock Price

- How to Track QQQ Stock Price

- QQQ Stock Price Historical Performance

- Key Milestones in QQQ Stock Price History

- QQQ Stock Price vs. Other ETFs

- Why Choose QQQ Over Other ETFs?

- QQQ Stock Price Forecast: What Lies Ahead?