Let me tell you something, the S&P 500 isn’t just another stock market index; it’s like the heartbeat of the global economy. Think of it as the ultimate playlist of 500 top-notch companies that define American business success. If you’re into investing or just curious about how the financial world works, this is the big league. The S&P 500 isn’t just a number on a screen—it’s a mirror reflecting the health of the economy, influencing everything from retirement accounts to global trade.

Now, let’s get real. If you’ve ever wondered why people talk about the S&P 500 like it’s the holy grail of finance, well, it kind of is. It represents about 80% of the total value of the U.S. stock market, making it a heavyweight champion in the world of investing. Whether you’re a seasoned pro or someone just dipping their toes into the financial waters, understanding the S&P 500 can give you a serious edge.

But here’s the kicker: it’s not all about numbers. The S&P 500 tells a story—a story of innovation, resilience, and growth. It’s where tech giants like Apple and Amazon rub shoulders with old-school powerhouses like Johnson & Johnson. So, buckle up because we’re about to deep-dive into what makes the S&P 500 tick, why it matters, and how it affects your wallet.

Read also:Clix Haircut Name The Trend Thats Cutting It In The Hair World

What Exactly is the S&P 500?

Alright, let’s break it down. The S&P 500, or Standard & Poor’s 500, is an index that tracks the performance of 500 large publicly traded companies in the U.S. It’s like a VIP club where only the best of the best get in. These companies are chosen based on factors like market size, liquidity, and sector representation. And guess what? It’s not just about picking big names; it’s about creating a balanced snapshot of the entire economy.

Here’s the deal: the S&P 500 is a market-capitalization-weighted index, meaning that companies with larger market values have more influence on the overall performance. Think of it as a popularity contest where bigger companies get more votes. This setup ensures that the index reflects the true pulse of the market, giving investors a reliable benchmark for their portfolios.

Why Does the S&P 500 Matter?

Let’s face it, the S&P 500 is a big deal. It’s not just a number; it’s a reflection of how well the economy is doing. When the S&P 500 is up, it usually means businesses are thriving, consumers are spending, and investors are feeling good. On the flip side, when it takes a dip, it can send ripples through the global financial system. So, whether you’re a day trader or someone with a 401(k), the S&P 500 is something you should keep an eye on.

How Does the S&P 500 Affect Your Investments?

Now, let’s talk about you. If you’ve got money in the stock market, chances are you’re already riding the S&P 500 wave. Many mutual funds and ETFs (Exchange-Traded Funds) are designed to mimic the performance of the S&P 500, giving investors broad exposure to the market without having to pick individual stocks. It’s like getting a diversified portfolio on autopilot.

But here’s the thing: the S&P 500 isn’t just for the pros. Regular folks can benefit from its stability and growth potential. Over the long term, the S&P 500 has delivered solid returns, making it a go-to option for retirement savings and other long-term goals. So, even if you’re not a finance guru, understanding the S&P 500 can help you make smarter investment decisions.

Key Benefits of Investing in the S&P 500

Here’s a quick rundown of why the S&P 500 is a solid choice for investors:

Read also:Best Twitter Pages Ifykyk A Deep Dive Into The Hottest Trends And Mustfollow Accounts

- Diversification: With 500 companies across various sectors, you’re spreading your risk.

- Stability: The S&P 500 is known for its resilience, bouncing back from downturns over time.

- Growth Potential: Historically, it’s delivered strong returns, making it a great option for long-term investors.

- Accessibility: You don’t need a fortune to invest; many funds and ETFs offer low-cost access to the S&P 500.

Understanding the Components of the S&P 500

So, who’s in this exclusive club? The S&P 500 includes companies from 11 major sectors, ranging from technology and healthcare to consumer goods and energy. It’s a well-rounded mix that ensures the index is representative of the entire economy. Some of the heavy hitters you’ll find here include Apple, Microsoft, Amazon, and Tesla, but there are also plenty of lesser-known names that play a crucial role in keeping the index strong.

Here’s a fun fact: the S&P 500 isn’t static. Companies can be added or removed based on changes in their market value or sector representation. It’s a dynamic index that evolves with the times, ensuring it stays relevant and reflective of the current economic landscape.

Top Sectors in the S&P 500

Let’s zoom in on the sectors that make up the S&P 500:

- Technology: Home to giants like Apple, Microsoft, and Alphabet, this sector drives innovation and growth.

- Healthcare: With companies like Johnson & Johnson and Pfizer, healthcare is a vital part of the index.

- Consumer Discretionary: Think Amazon, Nike, and Starbucks—brands that shape our daily lives.

- Financials: Banks, insurance companies, and investment firms keep the economy moving.

Historical Performance of the S&P 500

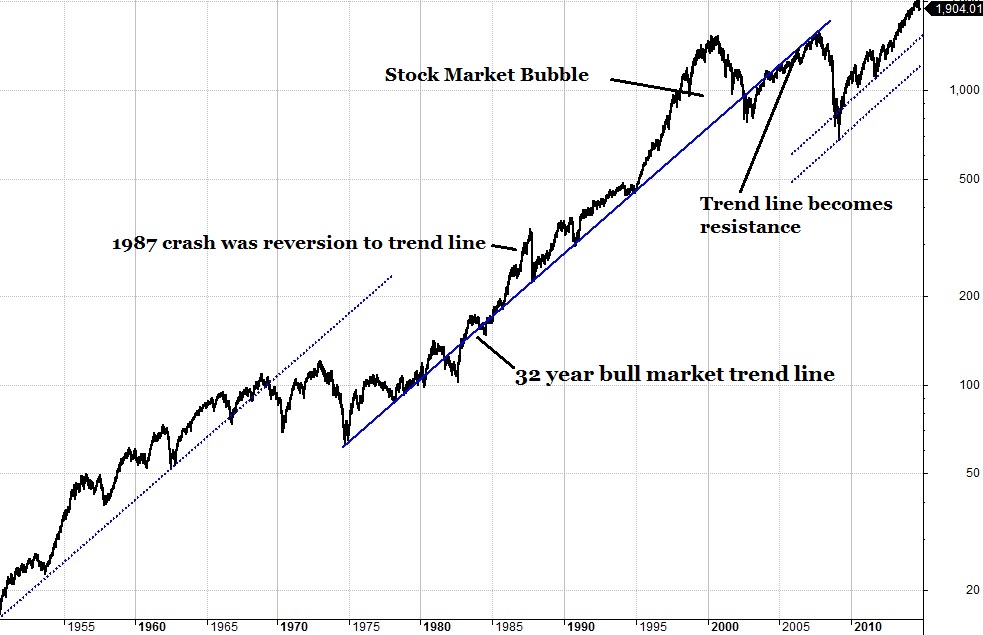

Looking back, the S&P 500 has a track record of delivering impressive returns. Since its inception in 1957, it’s averaged an annual return of around 10%. That’s not bad for a diversified index. Of course, there have been ups and downs along the way—remember the dot-com bubble and the 2008 financial crisis? But over the long term, the S&P 500 has proven to be a resilient and reliable investment vehicle.

Here’s a snapshot of its performance over the decades:

- 1950s: Setting the stage for future growth

- 1980s: The rise of tech and financial innovation

- 2000s: Navigating challenges and bouncing back stronger

- 2020s: Embracing the digital age and sustainable investing

Lessons from the Past

History has shown us that the S&P 500 is more than just a number; it’s a barometer of economic health. By studying its past performance, we can gain insights into how markets behave during different cycles. Whether it’s a bull market or a bear market, the S&P 500 offers valuable lessons for investors of all levels.

Risk and Volatility in the S&P 500

Let’s not sugarcoat it; investing in the S&P 500 comes with risks. Markets can be volatile, and short-term fluctuations can make even the most seasoned investors nervous. But here’s the thing: volatility isn’t always bad. It’s part of the game, and over time, the S&P 500 has shown a remarkable ability to recover and grow.

That said, it’s important to manage your expectations and have a solid investment strategy. Diversification, regular contributions, and a long-term mindset can help you weather the storms and reap the rewards of the S&P 500’s growth potential.

Managing Risk in Your Portfolio

Here are some tips for managing risk when investing in the S&P 500:

- Stay Diversified: Don’t put all your eggs in one basket; spread your investments across different asset classes.

- Set Realistic Goals: Know what you want to achieve and create a plan to get there.

- Stay Informed: Keep up with market trends and economic news to make informed decisions.

How to Invest in the S&P 500

Ready to jump in? Investing in the S&P 500 is easier than you might think. You can do it through mutual funds, ETFs, or even individual stocks. Many brokerage platforms offer low-cost options that make it accessible for everyone, from beginners to seasoned investors.

Here’s how you can get started:

- Choose a Broker: Find a reputable platform that offers S&P 500 funds or ETFs.

- Select Your Investment Vehicle: Decide whether you want a mutual fund, ETF, or a mix of both.

- Set Up a Regular Contribution Plan: Automate your investments to take advantage of dollar-cost averaging.

Popular S&P 500 ETFs

If you’re looking for ETFs that track the S&P 500, here are a few popular options:

- SPDR S&P 500 ETF Trust (SPY)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

Conclusion: Why the S&P 500 Should Be on Your Radar

Let’s recap: the S&P 500 is more than just a number; it’s a reflection of the global economy and a powerful tool for investors. Whether you’re looking to grow your wealth, secure your retirement, or simply understand how the financial world works, the S&P 500 offers valuable insights and opportunities.

So, what’s next? If you haven’t already, consider adding the S&P 500 to your investment portfolio. It’s a smart move that can pay off in the long run. And remember, knowledge is power. Stay informed, stay diversified, and most importantly, stay patient. The S&P 500 has proven time and again that it’s worth the ride.

Got questions or thoughts? Drop a comment below or share this article with a friend. Investing in the S&P 500 is a journey, and we’re all in this together. Let’s make the most of it!

Table of Contents

- What Exactly is the S&P 500?

- Why Does the S&P 500 Matter?

- How Does the S&P 500 Affect Your Investments?

- Understanding the Components of the S&P 500

- Historical Performance of the S&P 500

- Risk and Volatility in the S&P 500

- How to Invest in the S&P 500

- Popular S&P 500 ETFs

- Conclusion: Why the S&P 500 Should Be on Your Radar

![[숏폼] 오펜하이머, S&P500 목표치 4천으로 또 하향 SBS Biz](https://img.biz.sbs.co.kr/upload/2022/10/18/EYT1666055622602.jpg)

![[숏폼] 톰 리 "S&P500, 올해 사상 최고치 달성할 것" SBS Biz](https://img.biz.sbs.co.kr/upload/2023/07/18/BXl1689643205280.png)