Hey there, stock market enthusiasts! If you're looking for a platform that's shaking up the world of investing, you've come to the right place. Robinhood has been making waves since its launch, offering users a sleek, user-friendly way to trade stocks without those pesky fees. Whether you're a seasoned investor or just dipping your toes into the stock market, this platform might be exactly what you need to take your financial journey to the next level.

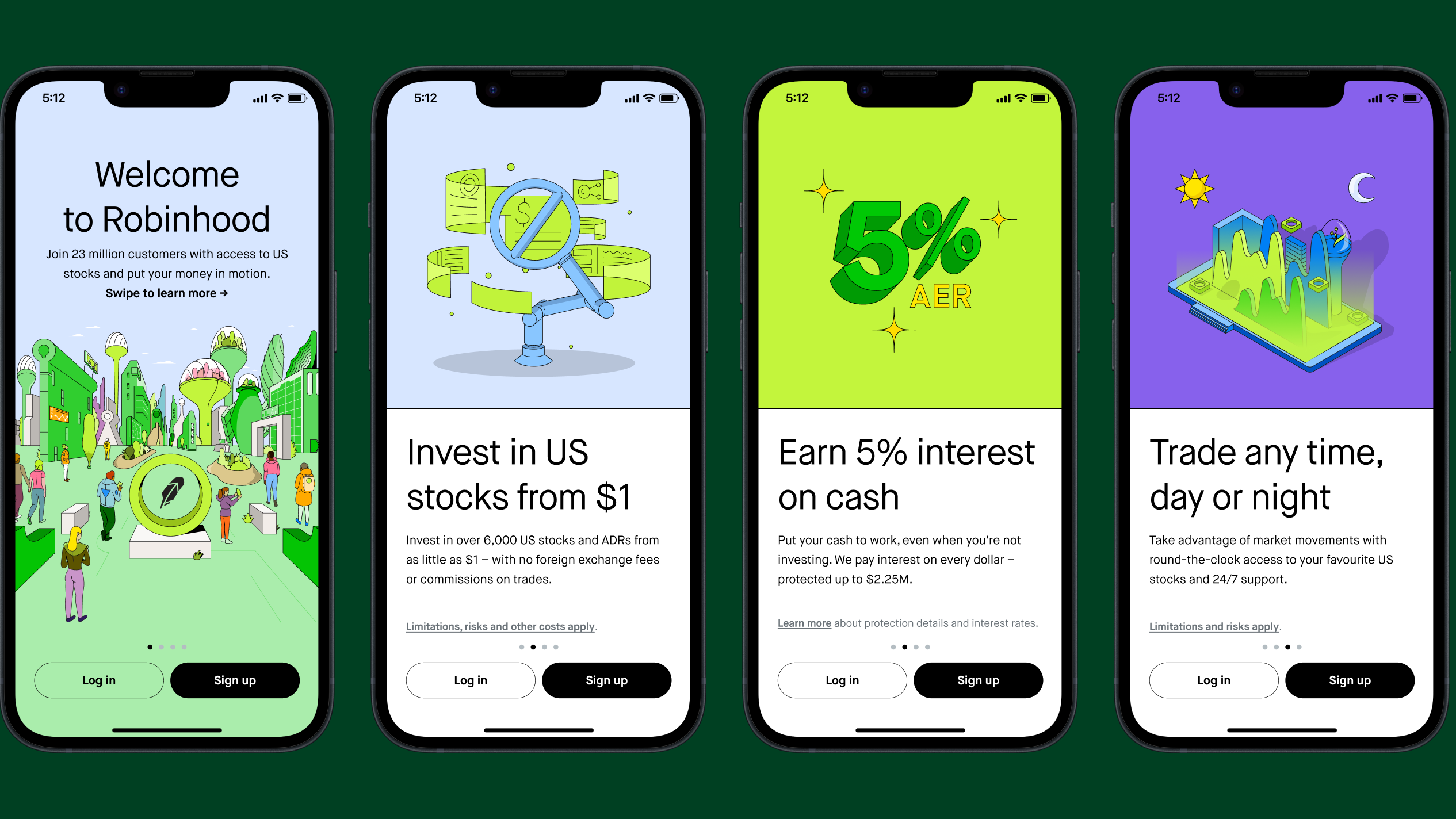

So, what exactly is Robinhood? In a nutshell, it's an investment app that allows you to trade stocks, options, ETFs, and even cryptocurrencies—all without paying commissions. That's right, folks, no hidden fees. This has made it a go-to choice for millions of users who want to build their portfolios without breaking the bank. But there's so much more to Robinhood than just free trades, and we're about to dive deep into all the juicy details.

Now, before we get into the nitty-gritty of how Robinhood works and why it's such a game-changer, let's talk about why this platform is worth your attention. In today's fast-paced financial world, having access to a reliable, cost-effective trading tool is more important than ever. Whether you're looking to grow your wealth over time or make some quick cash, Robinhood offers features that cater to both beginners and seasoned pros. So, buckle up, because we're about to explore everything you need to know about this revolutionary platform.

Read also:Robert Palmers Son Death The Tragic Story Behind The Headlines

What Makes Robinhood Stand Out?

Let's face it, the world of investing can be overwhelming, especially for beginners. But Robinhood has managed to simplify the process, making it accessible to everyone. Here's a quick rundown of what sets Robinhood apart from the competition:

- No commission fees on stock trades, making it super affordable for users.

- A sleek, intuitive app that's easy to navigate, even for those who are new to investing.

- Access to a wide range of investment options, including stocks, options, ETFs, and cryptocurrencies.

- Real-time market data and news updates to help you make informed decisions.

- A growing community of users who share tips and strategies for successful trading.

These features, combined with Robinhood's commitment to transparency and customer satisfaction, have helped it gain a massive following in a relatively short amount of time. But don't just take our word for it—let's dive deeper into what makes Robinhood so special.

How Robinhood Works

So, you're probably wondering how Robinhood manages to offer all these great features without charging fees. Well, it's all about the business model. While the basic version of Robinhood is free to use, the platform generates revenue through other means, such as:

- Premium subscription services like Robinhood Gold, which offers additional features like margin trading and access to more advanced tools.

- Interest on user cash balances, which is a common practice in the financial industry.

- Selling order flow data to market makers, which helps them execute trades more efficiently.

By diversifying its revenue streams, Robinhood can continue to offer its core services for free while still maintaining a profitable business. This model has proven to be incredibly successful, attracting millions of users who appreciate the value they get from the platform.

The Rise of Robinhood: A Brief History

Robinhood wasn't always the household name it is today. The company was founded in 2013 by Vlad Tenev and Baiju Bhatt, two Stanford graduates who saw a need for a more accessible and affordable way to invest in the stock market. Their vision was simple: to democratize access to the financial markets by eliminating barriers like high fees and complicated trading platforms.

Since its launch, Robinhood has grown rapidly, expanding its offerings to include options trading, cryptocurrency, and even a checking and savings account. Along the way, the company has faced its share of challenges, including regulatory scrutiny and criticism from some traditional financial institutions. But through it all, Robinhood has remained committed to its mission of making investing accessible to everyone.

Read also:Jackerman 3d The Revolutionary Technology Changing The Game

Robinhood's Key Features

Now that you know a bit about Robinhood's history, let's take a closer look at some of its key features. Here's what you can expect when you sign up for the platform:

- Stock Trading: Buy and sell stocks commission-free, with real-time data and news updates to help you make informed decisions.

- Options Trading: Trade options with advanced tools and features, all without paying commissions.

- Cryptocurrency: Invest in popular cryptocurrencies like Bitcoin and Ethereum, with 24/7 access to the market.

- Robinhood Gold: A premium subscription service that offers margin trading, extended hours trading, and access to more advanced tools.

These features make Robinhood a versatile platform that can cater to a wide range of investors, from beginners to experienced traders. And with new features being added all the time, there's always something new to explore.

Is Robinhood Safe?

One of the most common questions people have about Robinhood is whether it's a safe platform to use. The short answer is yes, Robinhood is a legitimate and secure platform that takes the protection of its users' assets very seriously. Here's how they ensure your money and personal information are safe:

- All accounts are protected by SIPC insurance, which covers up to $500,000 in securities and $250,000 in cash.

- Robinhood uses advanced encryption and security protocols to protect user data and prevent unauthorized access.

- The platform is regulated by the SEC and FINRA, ensuring compliance with all applicable laws and regulations.

While no platform can guarantee 100% security, Robinhood's commitment to protecting its users has helped build trust and confidence in the platform. Of course, as with any investment platform, it's always a good idea to do your own research and make informed decisions about where to invest your money.

Robinhood vs Traditional Brokers

One of the biggest questions people have about Robinhood is how it stacks up against traditional brokers. While both offer ways to invest in the stock market, there are some key differences that set Robinhood apart. Here's a quick comparison:

- Cost: Robinhood offers commission-free trading, while traditional brokers often charge fees for each trade.

- Accessibility: Robinhood's app is designed to be user-friendly, making it easier for beginners to get started. Traditional brokers often have more complex platforms that can be intimidating for new users.

- Features: While traditional brokers may offer more advanced tools and features, Robinhood provides a solid set of tools that are sufficient for most users.

Ultimately, the choice between Robinhood and a traditional broker will depend on your individual needs and preferences. But for many users, Robinhood's affordability and ease of use make it an attractive option.

Robinhood's Impact on the Financial Industry

Since its launch, Robinhood has had a significant impact on the financial industry, challenging traditional brokers to rethink their business models and pricing strategies. By offering commission-free trading, Robinhood has set a new standard for what users should expect from an investment platform. This has led to increased competition and innovation in the industry, benefiting consumers in the long run.

But Robinhood's influence extends beyond just pricing. The platform has also helped to democratize access to the financial markets, making it easier for people from all walks of life to participate in investing. This has the potential to create a more financially literate and empowered society, which is something we can all get behind.

Challenges Facing Robinhood

Of course, no platform is without its challenges, and Robinhood is no exception. Some of the biggest challenges the company faces include:

- Regulatory Scrutiny: As a relatively new player in the financial industry, Robinhood has faced increased scrutiny from regulators, who are concerned about issues like order flow payment and margin lending.

- Market Volatility: Like all investment platforms, Robinhood is subject to the ups and downs of the stock market, which can impact user experience and satisfaction.

- Competition: With more traditional brokers now offering commission-free trading, Robinhood faces increased competition in the market.

Despite these challenges, Robinhood remains committed to its mission of making investing accessible to everyone. And with its growing user base and expanding offerings, the platform is well-positioned to continue its upward trajectory.

Conclusion: Is Robinhood Right for You?

So, there you have it—a comprehensive look at Robinhood and what it has to offer. Whether you're a seasoned investor or just starting out, Robinhood provides a powerful and affordable way to build your portfolio. But like any investment platform, it's important to do your research and make informed decisions about where to invest your money.

We encourage you to share your thoughts and experiences with Robinhood in the comments below. Have you tried the platform? What do you like or dislike about it? And if you found this article helpful, be sure to check out some of our other content on all things finance and investing. Together, we can build a more financially literate and empowered community!

Table of Contents

- What Makes Robinhood Stand Out?

- How Robinhood Works

- The Rise of Robinhood: A Brief History

- Robinhood's Key Features

- Is Robinhood Safe?

- Robinhood vs Traditional Brokers

- Robinhood's Impact on the Financial Industry

- Challenges Facing Robinhood

- Conclusion: Is Robinhood Right for You?