Let me drop a little truth bomb on you – premarket trading is like the backstage pass to the stock market concert. It's where the real action happens before the official opening bell rings. But here's the thing: not everyone knows how to navigate this mysterious pre-show. And that's exactly why you're here, right? You want to uncover the secrets of premarket trading and level up your investment game.

So, let's get real for a second. Premarket trading isn’t just some random activity; it’s a strategic move that can set you apart from the average trader. Think of it as the early bird special, but instead of pancakes, you're grabbing potential profits before the rest of the world wakes up. But before you dive headfirst into this world, you need to know the rules, the risks, and the rewards.

Now, I’m not gonna sugarcoat it – premarket trading comes with its own set of challenges. But hey, isn’t that what makes it exciting? The thrill of the hunt, the rush of decision-making, and the possibility of hitting the jackpot (or avoiding the pitfall). In this guide, we’ll break it all down for you, step by step, so you can approach premarket trading with confidence and clarity.

Read also:Unveiling The Mysteries Of Season Masa49 A Deep Dive Into The Phenomenon

What Exactly is Premarket Trading?

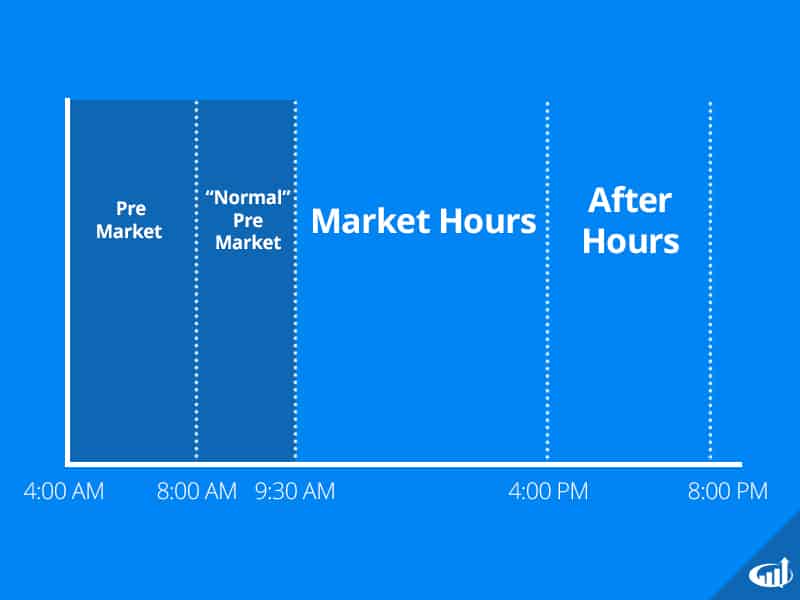

Alright, let’s start with the basics. Premarket trading is basically the trading activity that happens before the regular trading hours of the stock market. Most major exchanges, like the NYSE and NASDAQ, officially open at 9:30 AM EST. But guess what? You can start trading as early as 4:00 AM in some cases. Crazy, right? This extended trading window gives you a chance to react to news, earnings reports, and global events before the main show begins.

Here’s the kicker: premarket trading isn’t regulated the same way as regular trading. That means it’s often more volatile and less liquid. Translation? Prices can swing wildly, and it might be harder to buy or sell stocks at your desired price. But if you play your cards right, this volatility can work in your favor.

Why Should You Care About Premarket Trading?

Let’s be honest – the stock market is a 24/7 news cycle. Stuff happens all the time, and sometimes, it happens when the market is closed. That’s where premarket trading comes in. It allows you to act on breaking news, economic data, or company announcements without waiting for the official trading hours. If a company releases stellar earnings after hours, you don’t have to sit around twiddling your thumbs until 9:30 AM. You can jump in and capitalize on the momentum right away.

But here’s the thing: premarket trading isn’t for everyone. It requires a solid understanding of the market, quick decision-making skills, and a tolerance for risk. If you’re the type of person who gets anxious when stock prices fluctuate, this might not be your jam. On the other hand, if you thrive under pressure and love the thrill of the game, premarket trading could be your golden ticket.

Key Benefits of Premarket Trading

So, what’s the big deal about premarket trading? Here are some of the key benefits that make it worth considering:

- Early Access to Market Moves: Get a head start on the day’s trading action. If a stock is making waves in the premarket, chances are it’ll continue to trend during regular hours.

- React to Breaking News: Stay ahead of the curve by reacting to news and events as they happen, rather than waiting for the market to open.

- Increased Opportunities: With extended trading hours, you have more time to execute trades and adjust your strategy based on market conditions.

- Potential for Higher Returns: Volatility can create opportunities for big gains if you know how to navigate the market effectively.

The Risks You Need to Know

Now, let’s talk about the elephant in the room – the risks. Premarket trading isn’t all sunshine and rainbows. Here are some of the potential downsides you need to be aware of:

Read also:Mydesi Buzz The Ultimate Guide To The Latest Entertainment Sensation

- Low Liquidity: Fewer traders are active during premarket hours, which can make it harder to execute trades at your desired price.

- High Volatility: Prices can swing wildly based on news or rumors, leading to unexpected gains or losses.

- Wide Bid-Ask Spreads: The difference between the buying and selling prices can be larger in premarket trading, eating into your potential profits.

- Increased Risk of Manipulation: With fewer participants, it’s easier for large players to influence stock prices.

How to Minimize Risks in Premarket Trading

Don’t let the risks scare you off just yet. There are ways to mitigate them and trade more safely:

- Use Limit Orders: Set specific price limits to avoid getting caught in wild price swings.

- Stay Informed: Keep up with news and earnings reports to understand what’s driving market movements.

- Stick to Liquid Stocks: Focus on stocks with high trading volumes to reduce the impact of low liquidity.

- Set Stop-Loss Orders: Protect yourself from significant losses by automatically exiting trades if prices move against you.

Understanding Market Sentiment in Premarket Trading

Market sentiment is like the mood of the market – and in premarket trading, that mood can change in the blink of an eye. Pay attention to how investors are reacting to news, geopolitical events, and economic data. Are they optimistic or pessimistic? Are they buying aggressively or dumping stocks? Understanding market sentiment can help you make smarter trading decisions.

Pro tip: Look at premarket movers and shakers. These are stocks that are seeing significant price changes before the market opens. They can give you clues about what to expect during regular trading hours.

Tools to Track Market Sentiment

Here are some tools you can use to stay on top of market sentiment:

- Yahoo Finance: Check the premarket movers section to see which stocks are gaining or losing traction.

- TradingView: Use this platform to analyze charts and track real-time price movements.

- Seeking Alpha: Get insights from analysts and investors on what’s driving market sentiment.

Strategies for Successful Premarket Trading

Now that you know the basics, let’s talk strategy. Here are some approaches you can use to boost your chances of success in premarket trading:

1. News-Based Trading

React to breaking news and earnings reports to identify potential winners and losers. For example, if a company announces better-than-expected earnings, its stock might surge in the premarket. Conversely, if a company reports disappointing results, its stock could tank.

2. Technical Analysis

Use charts and technical indicators to identify trends and patterns in premarket price movements. Look for support and resistance levels, moving averages, and other signals that can help you make informed decisions.

3. Swing Trading

Take advantage of short-term price swings by buying low and selling high. This strategy requires patience and discipline, but it can be highly rewarding if executed correctly.

How to Get Started with Premarket Trading

Ready to take the plunge? Here’s a step-by-step guide to getting started with premarket trading:

- Choose a Broker: Not all brokers offer premarket trading, so make sure to select one that does. Popular options include Interactive Brokers, TD Ameritrade, and E*TRADE.

- Set Up an Account: Open a trading account and fund it with the amount you’re comfortable risking.

- Learn the Ropes: Spend some time familiarizing yourself with the platform and its features. Many brokers offer demo accounts where you can practice without risking real money.

- Develop a Strategy: Decide on your approach – whether it’s news-based trading, technical analysis, or something else – and stick to it.

- Start Small: Begin with small trades to minimize risk and build confidence. As you gain experience, you can gradually increase your position sizes.

Top Mistakes to Avoid in Premarket Trading

Even the best traders make mistakes. Here are some common pitfalls to avoid:

- Overtrading: Don’t get caught up in the excitement and make too many trades. Stick to your strategy and don’t let emotions drive your decisions.

- Ignoring Risk Management: Always have a plan for managing risk, including setting stop-loss orders and limiting your position sizes.

- Chasing Losses: If a trade goes against you, don’t try to recoup your losses by doubling down. Cut your losses and move on.

- Underestimating Volatility: Remember that premarket trading is more volatile than regular trading. Be prepared for wild price swings and adjust your strategy accordingly.

Conclusion: Is Premarket Trading Right for You?

So, there you have it – the lowdown on premarket trading. It’s a powerful tool that can help you stay ahead of the curve and capitalize on market opportunities. But it’s not without its risks. If you’re willing to put in the time and effort to learn the ropes and develop a solid strategy, premarket trading could be a game-changer for your investment portfolio.

Before you go, here’s a quick recap of the key takeaways:

- Premarket trading gives you early access to market moves and allows you to react to breaking news.

- It comes with risks, including low liquidity and high volatility, but these can be mitigated with proper risk management.

- Develop a strategy that works for you and stick to it, whether it’s news-based trading, technical analysis, or swing trading.

- Start small and gradually build your confidence and experience.

Now, it’s your turn. Are you ready to dive into the world of premarket trading? Leave a comment below and let us know what you think. And if you found this guide helpful, don’t forget to share it with your fellow traders. Together, we can unlock the secrets of the stock market and make smarter investment decisions.

Table of Contents

- What Exactly is Premarket Trading?

- Why Should You Care About Premarket Trading?

- Key Benefits of Premarket Trading

- The Risks You Need to Know

- How to Minimize Risks in Premarket Trading

- Understanding Market Sentiment in Premarket Trading

- Tools to Track Market Sentiment

- Strategies for Successful Premarket Trading

- How to Get Started with Premarket Trading

- Top Mistakes to Avoid in Premarket Trading