Hey there, friend! Let’s dive straight into the world of IRS stimulus checks. If you’ve been hearing all the buzz about these financial boosts, you’re in the right place. Whether you’re wondering if you qualify, how much you could receive, or when you’ll get your money, we’ve got all the answers for you. So, buckle up because we’re about to break it down in a way that’s easy to understand and packed with useful info!

IRS stimulus checks have been making headlines for a while now, and for good reason. These payments are designed to help individuals and families during tough economic times. But let’s be real—there’s a lot of confusion out there. From eligibility requirements to deadlines and everything in between, it can feel overwhelming. That’s why we’re here—to simplify the process and make sure you’re not missing out on what’s rightfully yours.

Before we dive deeper, let’s set the stage. The IRS has been rolling out these checks as part of broader economic relief efforts. It’s not just about handing out cash; it’s about supporting people like you who might need a little extra help. Think of it as a financial lifeline. Now, let’s get into the nitty-gritty details so you can make the most of this opportunity.

Read also:Valvoline Coupon 25 Synthetic 50 Off Your Ultimate Guide To Big Savings

Understanding the IRS Stimulus Check Program

First things first, what exactly is an IRS stimulus check? Simply put, it’s a payment sent directly to eligible individuals and families by the Internal Revenue Service (IRS). These checks are part of larger economic relief packages aimed at boosting the economy and helping those affected by various financial challenges. But here’s the kicker—they’re not automatic for everyone.

You might be wondering, “How do I know if I qualify?” Well, that’s where things get interesting. The IRS uses specific criteria to determine eligibility, and we’ll break it all down for you. From income limits to filing status, there’s a lot to consider. But don’t worry—we’ve got your back.

Who Qualifies for an IRS Stimulus Check?

Let’s talk about eligibility. To qualify for an IRS stimulus check, you need to meet certain criteria. Here’s a quick rundown:

- Your adjusted gross income (AGI) must fall below a certain threshold.

- You must have a valid Social Security number.

- You can’t be claimed as a dependent on someone else’s tax return.

- You must have filed a tax return for the previous year or be receiving certain benefits like Social Security.

Now, these rules can vary depending on the specific relief package. For example, some packages may include additional funds for dependents or offer higher income limits. It’s all about staying informed and up to date with the latest developments.

How Much Can You Expect to Receive?

Alright, let’s talk numbers. The amount you can expect to receive depends on several factors, including your income, filing status, and the number of dependents you have. Generally speaking, the payment structure looks something like this:

- Single filers with an AGI of $75,000 or less typically receive the full amount.

- Married couples filing jointly with an AGI of $150,000 or less also qualify for the full payment.

- For every dependent, you might receive an additional amount, depending on the specific relief package.

But here’s the thing—the payment amount phases out as your income increases. So, if you’re close to the threshold, it’s important to crunch the numbers and see where you stand. Trust us, it’s worth the effort.

Read also:Exploring Erome Your Ultimate Guide To This Mustknow Phenomenon

When Will You Receive Your IRS Stimulus Check?

This is one of the most common questions we get. When will the money actually hit your account? Well, the timeline can vary depending on how you filed your taxes. Here’s a quick breakdown:

- If you filed electronically and provided direct deposit information, you’ll likely receive your payment faster.

- If you opted for a paper check, it might take a bit longer, especially if the IRS is processing a high volume of payments.

- For those receiving payments via prepaid debit cards, the timeline can also vary.

It’s always a good idea to keep an eye on your bank account and check the IRS’s official website for updates. They often provide tracking tools to help you stay informed.

Common Questions About IRS Stimulus Checks

Let’s address some of the most frequently asked questions about IRS stimulus checks. These are the things people like you are wondering about, so we’re here to clear up any confusion.

What Happens if I Don’t Receive My Payment?

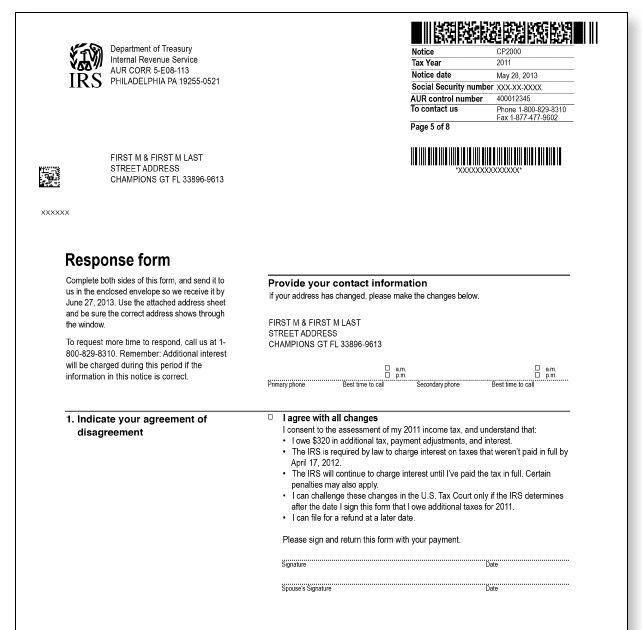

First off, don’t panic. If you believe you qualify but haven’t received your payment, there are steps you can take. Start by using the IRS’s Get My Payment tool to track your status. If that doesn’t resolve the issue, you can file a claim on your next tax return to request the missing amount.

Can I Still Qualify if I Didn’t File Taxes?

Yes, you can! Even if you didn’t file taxes, you might still qualify for an IRS stimulus check. The key is to submit a simplified tax return to the IRS. This allows them to process your payment based on the information you provide. It’s a straightforward process, and we highly recommend taking this step if you think you’re eligible.

How to Track Your IRS Stimulus Check

Staying on top of your payment status is crucial. The IRS offers a user-friendly tool called Get My Payment, which allows you to track the progress of your stimulus check. Here’s how it works:

- Visit the official IRS website and locate the Get My Payment tool.

- Enter your Social Security number, date of birth, and mailing address.

- The tool will provide an estimated date for when you can expect your payment.

It’s important to note that the information provided by the tool is updated regularly, so if you don’t see a status right away, check back in a few days. Patience is key!

Tips for a Smooth Payment Process

Here are a few tips to ensure a smooth payment process:

- Double-check your direct deposit information to avoid delays.

- Keep an eye on your mail if you’re expecting a paper check.

- Stay informed by following updates from the IRS and reputable news sources.

By taking these steps, you’ll be well-prepared for when your payment arrives.

What to Do Once You Receive Your IRS Stimulus Check

Now that you’ve got your payment, what’s next? Here are some ideas:

- Pay off high-interest debt to improve your financial health.

- Build or boost your emergency fund for future peace of mind.

- Invest in your education or skills to enhance your career prospects.

The possibilities are endless, but the key is to use the money wisely. Think about your long-term goals and how this payment can help you achieve them.

Can You Spend the Money on Anything?

Absolutely! There are no restrictions on how you can use your IRS stimulus check. Whether you choose to save it, spend it, or invest it, the decision is entirely yours. Just remember to prioritize your financial well-being and make choices that align with your goals.

Expert Insights and Advice

When it comes to IRS stimulus checks, it’s always a good idea to seek expert advice. Financial advisors and tax professionals can provide valuable insights and help you navigate the process. Here are a few tips from the pros:

- Keep detailed records of your payment and any related correspondence with the IRS.

- Be cautious of scams—only trust official communication from the IRS.

- Consider consulting a tax professional if you have complex financial situations.

By leveraging expert advice, you can ensure you’re making the most of your stimulus check and avoiding potential pitfalls.

Staying Informed: The Key to Success

Knowledge is power, especially when it comes to IRS stimulus checks. Stay informed by following updates from the IRS and reputable news outlets. Sign up for alerts or newsletters to ensure you’re always in the loop. Remember, the more you know, the better equipped you’ll be to handle any situation that arises.

Final Thoughts and Call to Action

There you have it—the ultimate guide to IRS stimulus checks. From understanding eligibility to tracking your payment and making the most of your funds, we’ve covered it all. But here’s the thing—knowledge is only the first step. Now it’s time to take action.

We encourage you to share this article with friends and family who might benefit from the information. Leave a comment below with your thoughts or questions. And don’t forget to explore other resources on our site for more tips and insights on financial wellness.

Remember, the IRS stimulus check is here to help you. So, go ahead and claim what’s rightfully yours. You’ve got this!

Table of Contents

- Understanding the IRS Stimulus Check Program

- Who Qualifies for an IRS Stimulus Check?

- How Much Can You Expect to Receive?

- When Will You Receive Your IRS Stimulus Check?

- Common Questions About IRS Stimulus Checks

- How to Track Your IRS Stimulus Check

- Tips for a Smooth Payment Process

- What to Do Once You Receive Your IRS Stimulus Check

- Expert Insights and Advice

- Final Thoughts and Call to Action