Crude oil prices are like the heartbeat of the global economy—every fluctuation sends ripples across industries, markets, and households. From the gas station down your street to the stock exchange in New York, crude oil prices dictate the flow of money and resources. It's not just a number on a screen; it's a reflection of geopolitical tensions, supply and demand dynamics, and even Mother Nature's mood swings. If you've ever wondered why your fuel bill spikes one month and drops the next, this article is your key to understanding the mysteries behind crude oil prices.

Let's face it, crude oil isn't just another commodity. It's the lifeblood of modern civilization. Whether you're driving to work, flying across continents, or simply heating your home, crude oil prices affect your wallet in more ways than you might realize. But how do these prices move? What makes them rise or fall? And most importantly, how can you stay ahead of the game when it comes to managing your expenses? Stick around, because we're about to unravel the secrets behind crude oil prices.

This isn't just another dry economics lesson. We're going to break it down in a way that's easy to digest, packed with real-world examples, and sprinkled with a dash of humor. So, grab a cup of coffee, settle in, and let's dive into the fascinating world of crude oil prices. Trust me, by the end of this article, you'll be speaking the language of energy traders like a pro.

Read also:Hyungry Temporary Replacement 3 Free The Ultimate Guide To Affordable Alternatives

Understanding the Basics of Crude Oil Prices

Before we get into the nitty-gritty, let's start with the basics. Crude oil is essentially unrefined petroleum that's extracted from the ground. Think of it as nature's black gold. The price of crude oil is determined by a complex interplay of factors, including supply and demand, geopolitical events, and market speculation. But here's the kicker—it's not as straightforward as buying apples at the grocery store.

In the world of crude oil, there are two major benchmarks: Brent crude and West Texas Intermediate (WTI). Think of them as the two big dogs in the energy market. Brent crude is the global benchmark, while WTI is the U.S. benchmark. Both are priced differently, but they move in tandem most of the time. Got it? Good. Now, let's move on to the fun stuff.

What Drives Crude Oil Prices?

Crude oil prices are like a rollercoaster ride—sometimes they're soaring high, and other times they're crashing down. So, what's behind all this volatility? Let's break it down:

Supply and Demand Dynamics

Supply and demand are the bread and butter of crude oil pricing. When supply is low and demand is high, prices tend to skyrocket. Conversely, when supply outpaces demand, prices take a nosedive. But here's the twist—supply and demand aren't just influenced by how much oil is being pumped out of the ground. They're also affected by factors like economic growth, seasonal patterns, and technological advancements.

For instance, during the winter months, demand for heating oil spikes, driving up prices. On the flip side, during the summer, people tend to travel more, increasing the demand for gasoline. It's all about timing and anticipating these trends.

Geopolitical Factors: The Wildcards in the Deck

Let's talk about the elephants in the room—geopolitical tensions. Wars, sanctions, and political instability in oil-producing regions can send crude oil prices through the roof. Take the Middle East, for example. It's home to some of the world's largest oil reserves, but it's also a hotbed of conflict. Any disruption in the region can have a ripple effect on global oil prices.

Read also:Clix Haircut Name The Trend Thats Cutting It In The Hair World

Then there's OPEC, the Organization of the Petroleum Exporting Countries. Think of OPEC as the kingmaker in the oil world. When OPEC decides to cut production, prices tend to rise. When they increase production, prices usually fall. It's all about maintaining balance in the market—or at least trying to.

Market Speculation: Betting on Black Gold

Speculators are like gamblers in the oil market. They buy and sell oil futures contracts, betting on whether prices will go up or down. Sometimes, their actions can amplify price movements, creating even more volatility. It's a risky game, but one that plays a significant role in shaping crude oil prices.

But here's the thing—speculators aren't all bad. They provide liquidity to the market, which helps oil producers and consumers hedge their risks. It's a double-edged sword, but one that's necessary for the smooth functioning of the oil market.

How Do Crude Oil Prices Affect You?

Now that we've covered the drivers of crude oil prices, let's talk about how they impact your everyday life. Whether you're a business owner, a commuter, or just someone trying to make ends meet, crude oil prices have a direct effect on your wallet. Here's how:

- Transportation Costs: Higher crude oil prices mean higher fuel costs, which can lead to increased transportation expenses. This, in turn, affects the prices of goods and services you buy.

- Energy Bills: If you rely on oil for heating or electricity, you'll feel the pinch when prices rise.

- Investment Opportunities: For savvy investors, fluctuations in crude oil prices can present lucrative opportunities in the energy sector.

Historical Trends in Crude Oil Prices

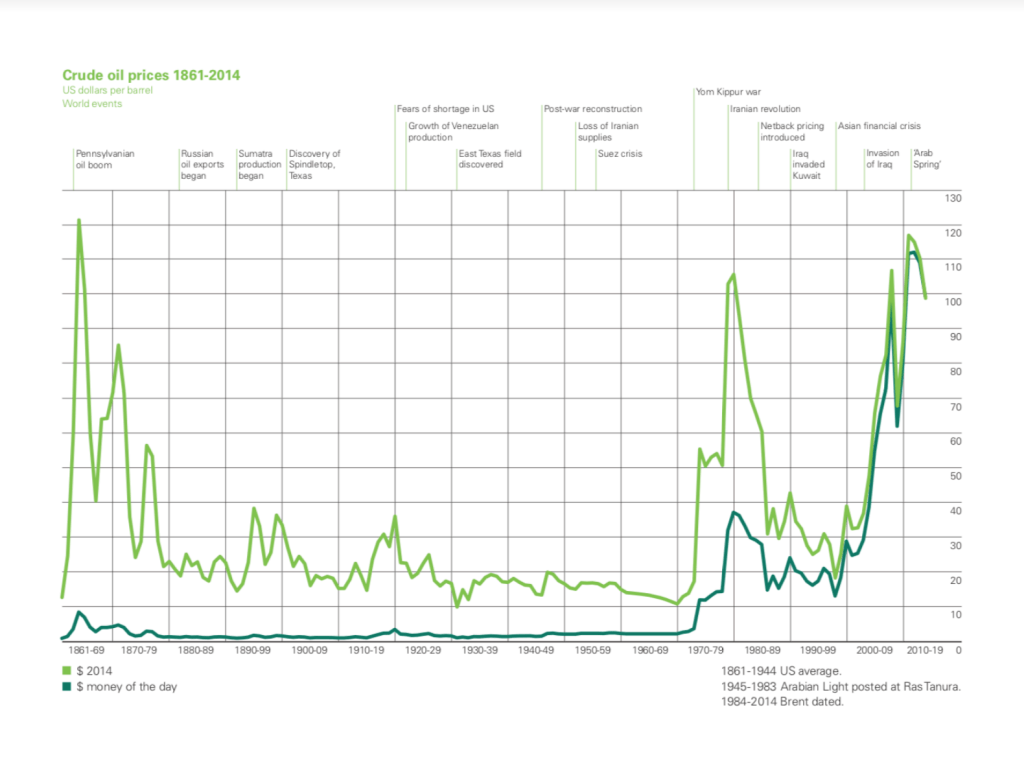

To understand where we're headed, it's important to look at where we've been. Over the past few decades, crude oil prices have experienced some wild swings. From the oil shocks of the 1970s to the record-high prices of 2008, the oil market has seen it all.

One of the most notable periods was the 2014-2016 oil price collapse. Prices plummeted from over $100 per barrel to below $30, sending shockwaves through the global economy. It was a wake-up call for many industries that relied heavily on oil. But as they say, what goes down must come up. Prices eventually rebounded, albeit with some lingering scars.

The Role of Technology in Shaping Crude Oil Prices

Technology is a game-changer in the oil industry. Advances in drilling techniques, such as hydraulic fracturing (fracking), have unlocked vast reserves of oil that were once considered unreachable. This has led to increased supply, putting downward pressure on prices.

At the same time, renewable energy technologies are gaining traction, posing a potential threat to the long-term demand for crude oil. As more countries commit to reducing their carbon footprint, the future of oil could look very different from today.

Forecasting Crude Oil Prices: A Crystal Ball or a Coin Toss?

Predicting crude oil prices is no easy feat. It's like trying to predict the weather—there are too many variables at play. However, analysts use a combination of historical data, market trends, and economic indicators to make educated guesses about where prices are headed.

One thing is certain—volatility is here to stay. Whether it's a natural disaster disrupting supply chains or a sudden surge in demand due to economic recovery, crude oil prices will continue to dance to the beat of their own drum.

Managing the Impact of Crude Oil Prices on Your Finances

So, how can you protect yourself from the whims of the oil market? Here are a few tips:

- Energy Efficiency: Invest in energy-efficient appliances and vehicles to reduce your dependence on oil.

- Diversify Investments: If you're an investor, consider diversifying your portfolio to include non-oil-related assets.

- Stay Informed: Keep an eye on oil market news and trends to make informed decisions about your spending and investments.

Conclusion: Navigating the Turbulent Waters of Crude Oil Prices

In conclusion, crude oil prices are a complex and ever-changing beast. They're influenced by a multitude of factors, from supply and demand to geopolitical tensions and technological advancements. But despite their unpredictability, understanding crude oil prices can empower you to make smarter financial decisions.

So, the next time you fill up your gas tank or pay your heating bill, take a moment to appreciate the intricate web of forces that determine the price you pay. And remember, whether you're a consumer, a business owner, or an investor, staying informed is your best defense against the volatility of the oil market.

Now, it's your turn. Got any questions or insights about crude oil prices? Drop a comment below and let's keep the conversation going. And don't forget to share this article with your friends and family—it might just save them a few bucks!

Table of Contents

- Understanding the Basics of Crude Oil Prices

- What Drives Crude Oil Prices?

- Geopolitical Factors: The Wildcards in the Deck

- Market Speculation: Betting on Black Gold

- How Do Crude Oil Prices Affect You?

- Historical Trends in Crude Oil Prices

- The Role of Technology in Shaping Crude Oil Prices

- Forecasting Crude Oil Prices: A Crystal Ball or a Coin Toss?

- Managing the Impact of Crude Oil Prices on Your Finances

- Conclusion: Navigating the Turbulent Waters of Crude Oil Prices