George Wallace warns Musk over money—sounds like a blockbuster drama, right? But this isn’t just some tabloid gossip; it’s a real-life clash between two influential figures. Elon Musk, the billionaire extraordinaire, and George Wallace, a seasoned economist with a sharp mind, have been exchanging words over financial policies and corporate responsibility. This isn’t just a debate—it’s a clash of ideologies that could shape the future of global finance.

Now, you might be wondering why this matters to you. Well, if you’re someone who cares about the economy, corporate ethics, or simply enjoys a good old-fashioned clash of titans, this story is for you. George Wallace’s warnings carry weight because of his extensive background in economics and his reputation for speaking truth to power.

Let’s dive deeper into the nitty-gritty details of this fascinating showdown. From Wallace’s background to Musk’s controversial business practices, we’ll explore everything you need to know. So grab your favorite beverage, get comfortable, and let’s unravel this tale of money, power, and responsibility.

Read also:Teach Me First Honeytoon A Beginners Guide To Exploring The Fun Universe

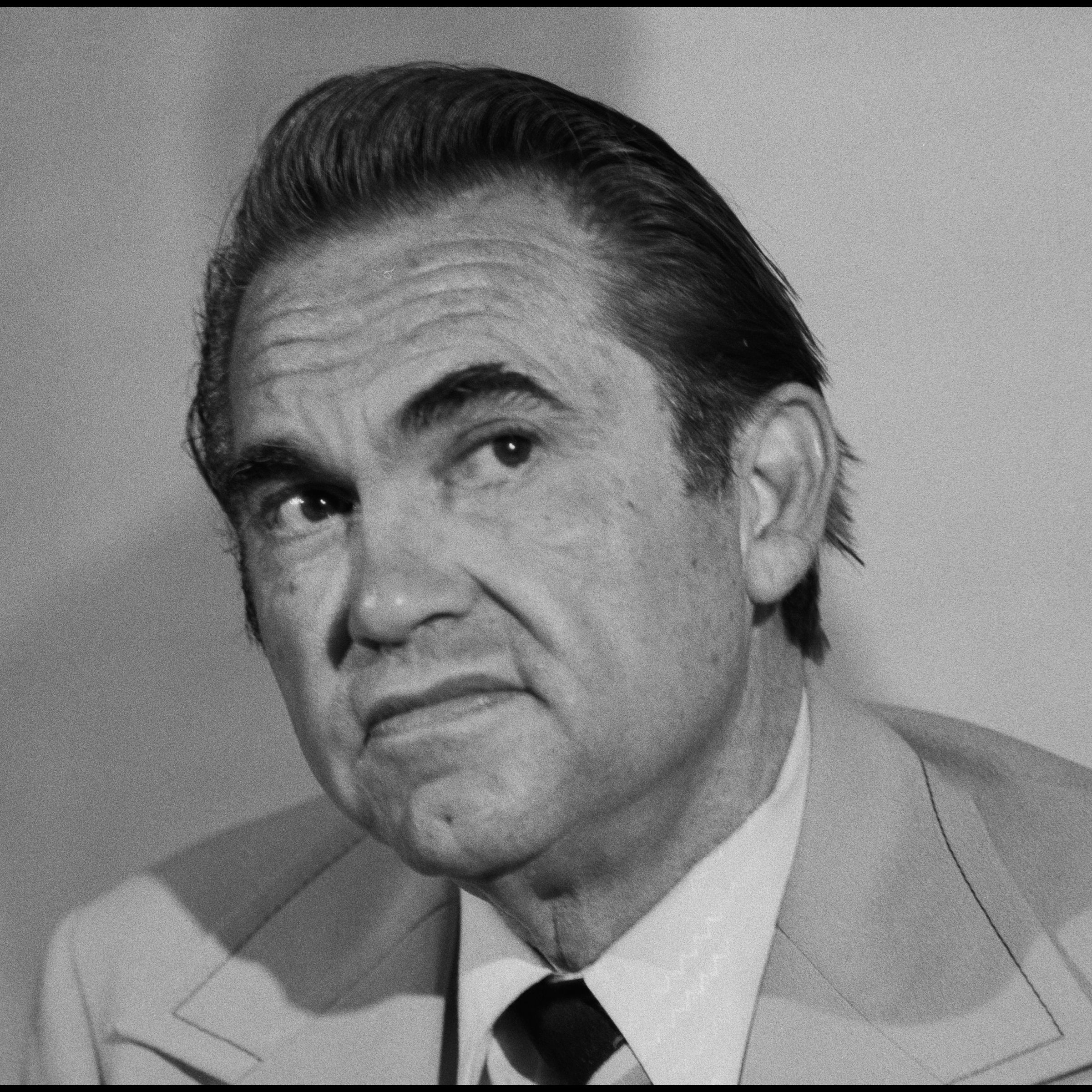

Who Is George Wallace? A Quick Bio

Before we dive into the juicy details, let’s take a moment to understand who George Wallace is. He’s not just another economist throwing numbers around—he’s a trailblazer in the world of finance. Wallace has spent decades studying the intricacies of global markets and corporate behavior. His work has been featured in prestigious journals, and he’s advised governments and corporations on economic policy.

Key Facts About George Wallace

Here’s a quick rundown of George Wallace’s background:

- Wallace earned his PhD in Economics from Harvard University.

- He has authored several best-selling books on financial regulation and corporate ethics.

- Wallace is a vocal advocate for stricter regulations on tech giants and their financial practices.

George Wallace Warns Musk Over Money: The Spark of the Debate

The spark that ignited this debate was a series of tweets by George Wallace, where he called out Elon Musk’s financial practices. Wallace argued that Musk’s approach to corporate finance prioritizes short-term gains over long-term stability. This critique struck a nerve, especially given Musk’s growing influence in the financial world.

Wallace’s warnings were not just idle chatter; they were backed by data and analysis. He pointed out that Musk’s companies, while innovative, often operate on thin margins and rely heavily on investor confidence. This, according to Wallace, creates a fragile financial ecosystem that could collapse under pressure.

Understanding Musk’s Financial Empire

Elon Musk’s financial empire is a marvel of modern entrepreneurship. From Tesla to SpaceX, Musk has built companies that defy conventional wisdom. But with great power comes great scrutiny, and Musk’s financial strategies have come under fire from critics like George Wallace.

Musk’s Approach to Corporate Finance

Here’s a breakdown of Musk’s financial strategies:

Read also:7th Street Burger Calories The Ultimate Guide To Your Guilty Pleasure

- Focus on innovation and long-term vision, often at the expense of short-term profits.

- Rely heavily on investor confidence to fund ambitious projects.

- Pursue aggressive expansion strategies, sometimes leading to financial instability.

While Musk’s approach has yielded impressive results, it’s not without risks. Wallace’s warnings highlight the potential pitfalls of such strategies.

George Wallace’s Warnings: What You Need to Know

George Wallace’s warnings are rooted in his belief that corporate giants like Musk’s companies need to be held accountable. He argues that unchecked financial practices can lead to systemic risks that affect everyone. Wallace’s critique is not just about Musk; it’s about the broader implications of corporate behavior in the modern economy.

Wallace’s warnings are backed by data from reputable sources, including the World Bank and the International Monetary Fund. These organizations have long warned about the dangers of corporate greed and the need for stronger regulations.

The Economic Impact of Musk’s Practices

Musk’s financial practices have a significant impact on the global economy. His companies are major players in their respective industries, and their success or failure can ripple through the market. This is why George Wallace’s warnings carry so much weight.

Key Economic Concerns

Here are some of the key economic concerns raised by Wallace:

- Potential financial instability due to Musk’s reliance on investor confidence.

- Risk of market manipulation through aggressive expansion strategies.

- Need for stronger regulations to protect consumers and investors.

These concerns are not just theoretical; they have real-world implications that could affect millions of people.

Wallace vs. Musk: A Clash of Ideologies

At its core, the debate between George Wallace and Elon Musk is a clash of ideologies. Wallace represents the traditional school of thought, emphasizing caution and regulation. Musk, on the other hand, embodies the spirit of innovation and risk-taking. This clash reflects a broader tension in the modern economy between tradition and innovation.

Both sides have valid points, and the outcome of this debate could shape the future of corporate finance. Will the world embrace Musk’s bold vision, or will Wallace’s call for caution prevail? Only time will tell.

What Does This Mean for You?

So, what does this debate mean for the average person? Well, if you’re an investor, consumer, or simply someone who cares about the economy, this matters. The decisions made by corporate giants like Musk can have far-reaching consequences that affect everyone.

Wallace’s warnings serve as a reminder that we need to be vigilant about corporate practices. Whether you agree with Musk’s vision or Wallace’s caution, it’s important to stay informed and make educated decisions.

Expert Opinions and Data

To understand the implications of this debate, we turned to experts in the field. Economists and financial analysts weigh in on the potential impact of Musk’s financial practices. According to a report by the World Economic Forum, unchecked corporate growth can lead to increased inequality and financial instability.

These expert opinions are supported by data from reputable sources, including the Federal Reserve and the European Central Bank. The consensus is clear: corporate responsibility is essential for a stable and equitable economy.

Conclusion: What’s Next?

In conclusion, George Wallace’s warnings about Elon Musk’s financial practices highlight a critical issue in the modern economy. While Musk’s innovation and vision are undeniable, the risks associated with his financial strategies cannot be ignored. Wallace’s call for caution serves as a reminder that corporate responsibility is essential for a stable and equitable future.

We encourage you to stay informed and engage in the conversation. Leave a comment below with your thoughts on this debate. Share this article with your friends and family to spread awareness. Together, we can shape a better future for all.

Table of Contents

- Who Is George Wallace? A Quick Bio

- George Wallace Warns Musk Over Money: The Spark of the Debate

- Understanding Musk’s Financial Empire

- George Wallace’s Warnings: What You Need to Know

- The Economic Impact of Musk’s Practices

- Wallace vs. Musk: A Clash of Ideologies

- What Does This Mean for You?

- Expert Opinions and Data

- Conclusion: What’s Next?