Let’s dive straight into the drama that has sent shockwaves across Wall Street and beyond. Donald Trump, the billionaire mogul turned ex-president, is back in the headlines—this time for a financial misstep that could redefine his legacy. The infamous $79 million overdraft at a NYC bank is the talk of the town, and trust me, it’s not a story you want to miss. Whether you’re a fan or a critic, this is one chapter in Trump's saga that’s too juicy to overlook.

Imagine this: A man who prides himself on being a financial wizard, a real estate tycoon, and a master negotiator, suddenly finds himself embroiled in a banking scandal. It sounds like the plot of a Hollywood blockbuster, but nope, this is real life. The $79 million overdraft at a New York City bank is not just a number—it’s a symbol of what happens when even the richest among us stumble.

Before we dive deeper, let’s set the stage. This isn’t just about money; it’s about trust, accountability, and the ripple effects of financial mismanagement. In today’s world, where every move is scrutinized, this story serves as a cautionary tale for everyone, from corporate executives to small business owners. So, buckle up, because we’re about to unravel the mystery behind Trump's NYC bank blunder.

Read also:7th Street Burger Calories The Ultimate Guide To Your Guilty Pleasure

Table of Contents

- Background: Trump's Financial Empire

- The $79M Overdraft: What Happened?

- Biography: Who Is Donald Trump?

- Impact on Trump's Reputation

- Legal Implications and Fallout

- Lessons Learned from the Blunder

- Can Trump Recover?

- Market Reactions and Economic Ramifications

- What’s Next for Trump?

- Conclusion: The Takeaway

Background: Trump's Financial Empire

Donald Trump’s rise to fame began long before his presidency. From skyscrapers to golf courses, his name became synonymous with wealth and success. But behind the glitz and glamour lies a complex web of financial dealings that have often sparked controversy. To truly understand the magnitude of the $79 million overdraft, we need to take a step back and examine the foundation of Trump's financial empire.

In the 1980s, Trump emerged as a dominant force in real estate, acquiring iconic properties like the Plaza Hotel and developing luxury towers across Manhattan. His aggressive business tactics earned him both admiration and criticism. However, this aggressive expansion came at a cost. Trump’s reliance on loans and leveraged buyouts often put him on the brink of financial disaster. It’s a pattern that has repeated itself throughout his career.

Fast forward to today, and Trump’s financial empire is still a mix of triumphs and tribulations. The $79 million overdraft is just the latest in a long line of financial missteps. But how did it happen? Let’s break it down.

The $79M Overdraft: What Happened?

Here’s the million-dollar question—or should we say, the $79 million question. According to reports, Trump’s accounts at a major NYC bank were overdrawn by a staggering $79 million. How does someone with Trump’s net worth end up in such a predicament? Well, it’s not as simple as forgetting to balance a checkbook.

Key Factors Behind the Overdraft

- Cash Flow Issues: Trump’s businesses often operate on thin margins, relying heavily on incoming revenue to cover expenses.

- Complex Financial Structures: With numerous companies under his umbrella, managing cash flow can be a logistical nightmare.

- Market Volatility: The economic climate in recent years has been unpredictable, affecting even the most seasoned investors.

It’s worth noting that this isn’t the first time Trump has faced financial challenges. In the past, he’s navigated through bankruptcies and restructurings, always emerging with a renewed vigor. But this time, the stakes are higher, and the scrutiny is intense.

Read also:Best Twitter Pages Ifykyk A Deep Dive Into The Hottest Trends And Mustfollow Accounts

Biography: Who Is Donald Trump?

Before we delve further into the scandal, let’s take a moment to understand the man behind the headlines. Donald J. Trump was born on June 14, 1946, in Queens, New York. He inherited his love for real estate from his father, Fred Trump, a successful developer. After graduating from the Wharton School of Business, Trump took the reins of the family business and transformed it into a global brand.

Here’s a quick glance at his life:

| Full Name | Donald John Trump |

|---|---|

| Birthdate | June 14, 1946 |

| Place of Birth | Queens, New York |

| Education | Wharton School of Business, University of Pennsylvania |

| Occupation | Businessman, Television Personality, Former President |

Trump’s career is a tapestry of achievements and controversies, making him one of the most polarizing figures of our time. Whether you love him or hate him, there’s no denying his impact on the world stage.

Impact on Trump's Reputation

The $79 million overdraft has dealt a significant blow to Trump’s reputation. For someone who prides himself on being a financial guru, this blunder is a PR nightmare. Critics are quick to point out the irony of a man who once called himself the "King of Debt" now struggling to manage his own finances.

But the impact goes beyond mere reputation. This scandal has raised questions about Trump’s financial literacy and management skills. It’s a reminder that even the most successful individuals are not immune to financial pitfalls. For Trump, this is a moment of reckoning, and the world is watching closely to see how he handles it.

Legal Implications and Fallout

When you’re dealing with sums as large as $79 million, legal implications are inevitable. Trump’s overdraft has sparked investigations and inquiries from various regulatory bodies. While no formal charges have been filed yet, the scrutiny is intense, and the pressure is mounting.

Potential Legal Outcomes

- Fraud Allegations: Some critics argue that the overdraft could be seen as a form of fraud, especially if it was intentional.

- Bank Repercussions: The bank involved may face regulatory fines for not catching the issue sooner.

- Personal Liability: Trump himself could face personal liability if it’s proven that he acted negligently.

As the legal battle unfolds, one thing is certain: this scandal will have lasting repercussions for all parties involved.

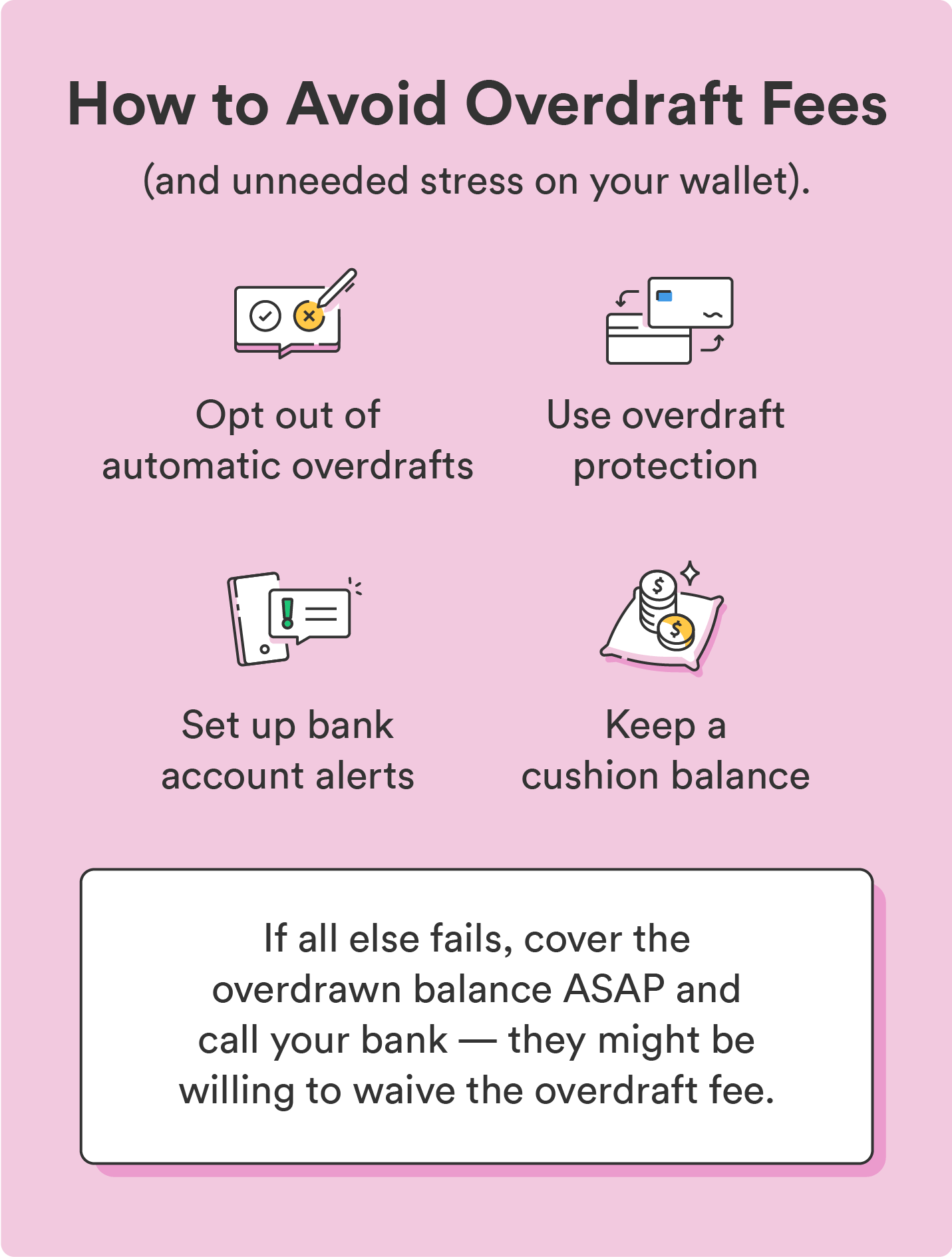

Lessons Learned from the Blunder

Every crisis is an opportunity to learn, and Trump’s overdraft is no exception. For individuals and businesses alike, there are valuable lessons to be gleaned from this debacle.

Top Takeaways

- Cash Flow Management: Always have a solid plan for managing cash flow, especially in volatile markets.

- Transparency: Be transparent with your financial dealings to avoid unnecessary scrutiny.

- Risk Management: Diversify your investments and avoid putting all your eggs in one basket.

For Trump, this is a wake-up call to revisit his financial strategies and make the necessary adjustments. It’s a lesson that extends beyond his personal circumstances, offering valuable insights for anyone navigating the complex world of finance.

Can Trump Recover?

Donald Trump has a knack for bouncing back, and many are wondering if he can do it again. Despite the odds, Trump has a track record of resilience, often turning setbacks into comebacks. But this time, the challenge is greater, and the stakes are higher.

Possible Recovery Strategies

- Rebranding: Trump could focus on rebranding himself as a financial reformer, using this scandal as a catalyst for change.

- Strategic Partnerships: Partnering with established financial institutions could help restore trust and credibility.

- Public Apology: A sincere apology and a commitment to transparency could go a long way in repairing his reputation.

Only time will tell if Trump can recover from this latest setback. One thing is certain: the world will be watching with bated breath.

Market Reactions and Economic Ramifications

The financial markets have reacted swiftly to Trump’s overdraft scandal. Investors are concerned about the potential ripple effects on the broader economy. While the immediate impact may be limited, the long-term consequences could be significant.

Potential Economic Impacts

- Real Estate Market: Trump’s properties may see a decline in value due to the uncertainty surrounding his finances.

- Investor Confidence: The scandal could erode investor confidence in Trump-branded ventures.

- Regulatory Changes: This could lead to stricter regulations on high-net-worth individuals and corporate accounts.

As the dust settles, the economic landscape may look very different, with new regulations and safeguards in place to prevent similar incidents in the future.

What’s Next for Trump?

Donald Trump has always been a man of surprises, and this scandal is no exception. As he navigates the aftermath of the $79 million overdraft, one thing is certain: he won’t go quietly into the night. Whether he chooses to focus on his business ventures or re-enter the political arena, Trump’s next move will be closely watched by millions around the world.

For now, the future remains uncertain, but one thing is clear: Trump’s story is far from over. Stay tuned for the next chapter in this ever-evolving saga.

Conclusion: The Takeaway

In conclusion, Trump's NYC bank blunder is more than just a financial mishap; it’s a reflection of the complexities of modern finance and the challenges faced by even the most successful individuals. From cash flow management to reputation management, there’s much to learn from this scandal.

We encourage our readers to share their thoughts in the comments section below. Do you think Trump can recover from this setback? What lessons can we take away from this story? And most importantly, what does the future hold for one of the most polarizing figures of our time?

As always, thank you for reading, and don’t forget to check out our other articles for more insights into the world of finance, politics, and everything in between. Until next time, keep it real!